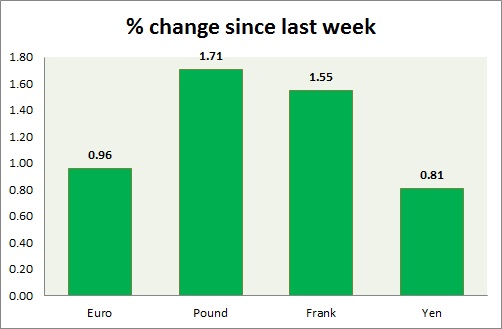

Dollar recovered after it was hard yesterday over FOMC against the majors (EUR, GBP, CHF, and JPY). Dollar index is at 98.13, up 1.50% today. This week's performance at a glance in chart and table -

- Euro, the best performer this week, traded above 1.11 against dollar, but was sold off sharply as long term investors used the opportunity to long the dollar. Euro is trading at the level it was trading prior to FOMC. Euro is currently trading at 1.065. Immediate Support lies at 1.05, 1.035 & Resistance 1.1035.

- Pound, worst performer this week, traded as high as 1.5164 but failed to keep the gain. Intraday 1.492 acted as a resistance and pound was sold off sharply after twice testing it. Pound is currently trading at 1.476. Immediate Support lies at 1.452, 1.462 & Resistance 1.494, 1.5175. Pound may depreciate towards 1.32 against dollar should the resistance at 1.555 holds.

- Yen traded more stable than other majors. The pair bounced back from key support near 119.5. All industry activity index rose by 1.9%. Yen is trading at 120.8; up by 0.15% in today's trading. Immediate Support lies at 118.25, 119.5 & Resistance 121.40, 122.

- Franc is the best performer in today's trading though further losses can't be ruled out. Today SNB kept monetary policy unchanged. Trade balance narrowed to 2.4 billion. Franc is currently trading at 0.992. Immediate Support lies at 0.96 & Resistance 1.008, 1.02.

|

Euro |

1.60% |

|

Pound |

0.24% |

|

Frank |

1.31% |

|

Yen |

0.54% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings