Dollar index trading at 94.44 (-0.1%)

Strength meter (today so far) – Euro +0.1%, Franc +0.13%, Yen -0.08%, GBP +0.16%

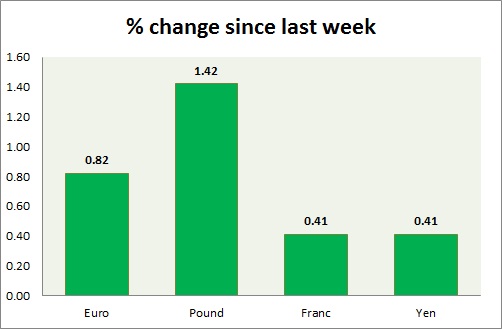

Strength meter (since last week) – Euro +0.82%, Franc +0.41%, Yen +0.41%, GBP +1.42%

EUR/USD –

Trading at 1.131

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Sell

Support

- Long term – 1.08, Medium term – 1.115, Short term – 1.125

Resistance –

- Long term – 1.17, Medium term – 1.153, Short term – 1.147

Economic release today –

- NIL

Commentary –

- Euro is hovering around 1.13 area, awaiting the FED. Our longer term target for Euro to reach as high as 1.20 against Dollar. Active short term call – Sell Euro @1.132 with target at 1.085 and stop loss at 1.148

GBP/USD –

Trading at 1.462

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range

Support –

- Long term – 1.4, Medium term – 1.4, Short term – 1.427

Resistance –

- Long term – 1.467, Medium term – 1.467, Short term – 1.467

Economic release today –

- UK GDP grew 0.4% in first quarter, up 2.1% from a year ago.

Commentary –

- Pound remains as best performer today and this week gaining on counter trend and Dollar weakness.

USD/JPY –

Trading at 111.3

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 108, Short term – 108

Resistance –

- Long term – 121, Medium term – 115, Short term – 111.2

Economic release today –

- All industry activity index declined -1.2% y/y in February.

- Tokyo CPI for April will be released at 23:30 GMT, along with national CPI for March and unemployment rate.

- Retail trade details will be released at 23:50 GMT.

Commentary –

- Yen continuing its weakness, awaiting Bank of Japan (BOJ) policy meeting tomorrow. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5 First three target reached, new target 90 added.

USD/CHF –

Trading at 0.972

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.98

Economic release today –

- UBS consumption index dropped to 1.51 in March, from 1.53 in February.

Commentary –

- Franc needs to break resistance around 0.95 area for further gains. We expect Franc to strengthen against Dollar to as high as 0.9 area.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed