Dollar index trading at 98.35 (-0.03%).

Strength meter (today so far) - Euro +0.22%, Franc +0.40%, Yen +0.33%, GBP -0.27%

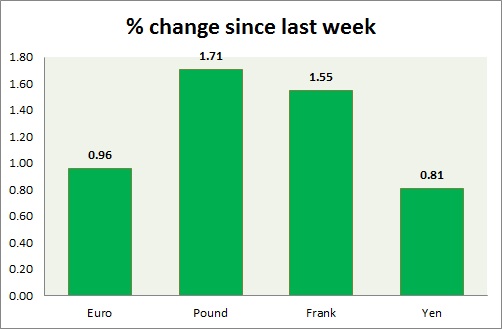

Strength meter (since last week) - Euro -1.11%, Franc -0.60%, Yen -0.68%, GBP -0.50%

EUR/USD -

Trading at 1.076

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Buy support/Sell resistance

Support -

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.07-1.073

Resistance -

- Long term - 1.1035-1.11, Medium term - 1.102-1.11, Short term - 1.102-1.105, Immediate - 1.083-1.085

Economic release today -

- Euro zone manufacturing PMI rose to 52.2 from prior 51

Commentary -

- Euro is showing strength today after days of heavy selling, however it is struggling to break above 1.08 level. Tested twice today.

- 1.07 is providing some support.

- Euro is worst performer this week.

GBP/USD -

Trading at 1.479

Trend meter -

- Long term - Range/Sell, Medium term - Sell, Short term - Range/Sell

Support -

- Long term - 1.425-1.417, Medium term - 1.462-1.455, Short term - 1.475-1.472

Resistance -

- Long term - 1.553-1.56, Medium term - 1.516-1.52, Short term - 1.498-1.502, Immediate - 1.485-1.487

Economic release today -

- Markit manufacturing PMI rose to 54.4 from prior 54.1

Commentary -

- Pound traded at today's high of 1.487 after positive PMI release, however dropped sharply towards 1.473 at 5 am eastern time. Struggling to break above 1.48 since then taking cues from dollar strength.

- Pound is the best performer this week so far, however worst performer today.

USD/JPY -

Trading at 119.5

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Sell

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118.2-118

Resistance -

- Long term - 125, Medium term - 122, Short term - 122, Immediate - 119.8-120.3

Economic release today -

- Manufacturing PMI fell to 50.3 from prior 51.6

Commentary -

- Pair rose fast from day's low of 119.5 towards 120.3 over dollar strength, however retraced sharply towards 119.5 after weak economic release from US. Dollar overall remains well bid against yen.

USD/CHF -

Trading at 0.968

Trend meter -

- Long term - Buy, Medium term - Sell/Range, Short term - Buy/Range/Sell Resistance

Support -

- Long term - 0.88, Medium term - 0.937, Short term - 0.945, Immediate - 0.954-0.951

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.997

Economic release today -

- SVME manufacturing PMI came in negative territory at

Commentary -

- Franc fell as low as 0.974 against dollar around 5 am Eastern Time, however retraced losses sharply and made to new session lows.

- Franc is the best performer today so far.

- Bulls might take the pair towards 0.99 level before selloff resumes.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand