Dollar index trading at 95.33 (+0.12%).

Strength meter (today so far) - Euro -0.23%, Franc -0.09%, Yen +0.02%, GBP -0.03%

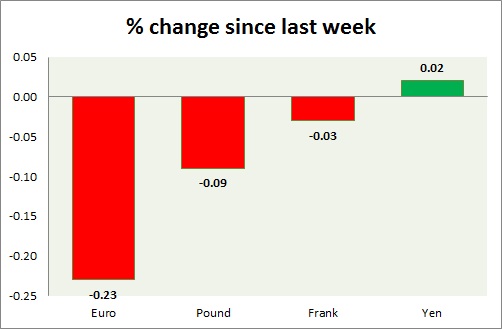

Strength meter (since last week) - Euro -0.23%, Franc -0.09%, Yen +0.02%, GBP -0.03%

EUR/USD -

Trading at 1.116

Trend meter -

- Long term - Sell, Medium term - Range/Buy Support, Short term - Buy

Support -

- Long term - 1.048-1.036, Medium term - 1.153-1.157, Short term - 1.106-1.102

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.128-1.132

Economic release today -

- Euro zone manufacturing PMI slowed to 52 in April, from prior 52.2

- Sentix investor confidence dropped to 19.6 in March from 20 prior.

Commentary -

- Euro is hovering below 1.12 to start of the week. Price has broken resistance around 1.105 last week, however struggling to maintain gains above 1.12 area. Further rise is very much likely.

GBP/USD -

Trading at 1.512

Trend meter -

- Long term - Range/Sell, Medium term - Sell, Short term - Range/Sell

Support -

- Long term - 1.425-1.417, Medium term - 1.462-1.455, Short term - 1.497- 1.494

Resistance -

- Long term - 1.553-1.56, Medium term - 1.553-1.56, Short term - 1.538

Economic release today -

- NIL

Commentary -

- Pound's advance were halted at long term support area of 1.55 and pound declined sharply thereafter. Bearish inverted hammer in weekly chart remains in focus.

USD/JPY -

Trading at 120.2

Trend meter -

- Long term - Buy, Medium term - Range/Sell, Short term - Range/Buy support/Sell resistance

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118.5-118

Resistance -

- Long term - 125, Medium term - 122, Short term - 122. Immediate - 120.8

Economic release today -

- NIL

Commentary -

- Yen has jumped back to 120 level after dollar bulls found support around 118.5 area. Yen might test 120.8 area this week.

USD/CHF -

Trading at 0.933

Trend meter -

- Long term - Buy, Medium term - Sell/Range, Short term - Range/Sell resistance

Support -

- Long term - 0.88, Medium term - 0.917, Short term - 0.93

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987, Immediate - 0.944-0.047

Economic release today -

- Manufacturing PMI for April remained in contraction zone came at 47.9.

Commentary -

- Franc is expected to appreciate further and test 0.89-0.9 area.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings