Dollar index trading at 98.82 (-0.11%)

Strength meter (today so far) – Euro +0.24%, Franc +0.01%, Yen -0.15%, GBP -0.19%

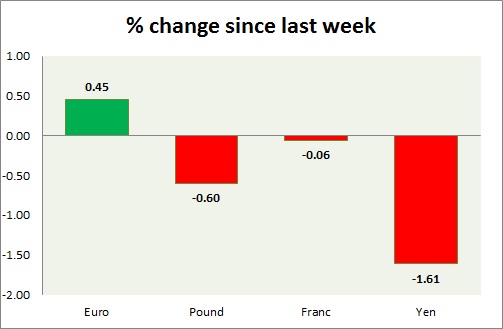

Strength meter (since last week) – Euro +0.45%, Franc -0.06%, Yen -1.61%, GBP -0.60%

EUR/USD –

Trading at 1.092

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.06, Medium term – 1.08, Short term – 1.08

Resistance –

- Long term – 1.16, Medium term – 1.143, Short term – 1.132

Economic release today –

- Consumer confidence came at -8

- Services sentiment improved to 12

- Business climate for October came at 0.55

- Industrial confidence for October declined to -0.6

- Economic sentiment indicator rose to 106.3

Commentary –

- The euro is the only counter, positive against the dollar this week. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01. stop loss revised to 1.13

GBP/USD –

Trading at 1.215

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.25, Short term – 1.24

Economic release today –

- NIL

Commentary –

- The pound is down as North Irish court rejects Brexit challenge. The pound has reached our target 1.2 area. We expect the pound to reach parity.

USD/JPY –

Trading at 105.4

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 91, Medium term – 98, Short term – 98

Resistance –

- Long term – 111, Medium term – 107, Short term – 107

Economic release today –

- NIL

Commentary –

- The yen remains the worst performer of the week and still the only counter against the dollar. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5. All targets reached, new target 90 added. Yen may retrace to 111 per dollar if BOJ intervenes.

USD/CHF –

Trading at 0.994

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.9, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.995

Economic release today –

- KOF leading indicator rose sharply to 104.7

Commentary –

- Franc continues to hover around parity. We expect Franc to strengthen against Dollar to as high as 0.86 area in the medium term. However, this call is under threat currently. We could soon revise the call.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX