Dollar index trading at 96.12 (+0.76%).

Strength meter (today so far) - Euro -0.76%, Franc -0.43%, Yen -0.24%, GBP -0.90%

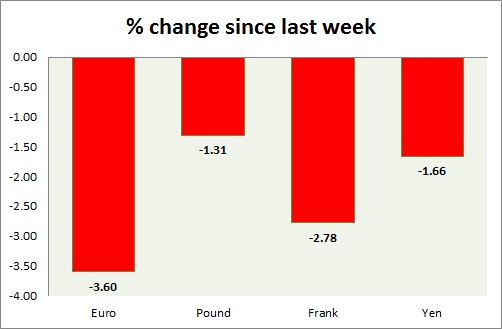

Strength meter (since last week) - Euro -3.60%, Franc -2.78%, Yen -1.66%, GBP -1.31%

EUR/USD -

Trading at 1.103

Trend meter -

- Long term - Sell, Medium term - Range/Sell, Short term - Range/Sell Resistance

Support -

- Long term - 1.048-1.036, Medium term - 1.106-1.102, Short term - 1.11-1.106(broken)

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.12-1.123

Economic release today -

- NIL

Commentary -

- Euro posed comeback post German GDP and IFO data, trading as high as 1.12 however stronger than expected US core CPI spoiled the rally and Euro broke below key support.

GBP/USD -

Trading at 1.551

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.537-1.534

Resistance -

- Long term - 1.592-1.616, Medium term - 1.58-1.586, Short term - 1.582-1.584, Immediate - 1.57

Economic release today -

- NIL

Commentary -

- Pound swept all of its yesterday's gain after dollar solidified post CPI. Further downside seems likely, expect high volatility.

USD/JPY -

Trading at 121.4

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118.5-118

Resistance -

- Long term - 125, Medium term - 122, Short term - 122.

Economic release today -

- Bank of Japan held its monetary policy steady.

Commentary -

- Yen is relatively better performer, as Bank of Japan shrugged off any further stimulus.

USD/CHF -

Trading at 0.943

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy support

Support -

- Long term - 0.88, Medium term - 0.917-0.913, Short term - 0.90

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987, Immediate - 0.944-0.947

Economic release today -

- NIL

Commentary -

- The pair has reached immediate resistance area, partial profit booking is suggested. Buying at dips remain strategy.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate