Dollar index trading at 93.13 (+0.14%).

Strength meter (today so far) - Euro -0.28%, Franc -0.08%, Yen +0.30%, GBP +0.03%

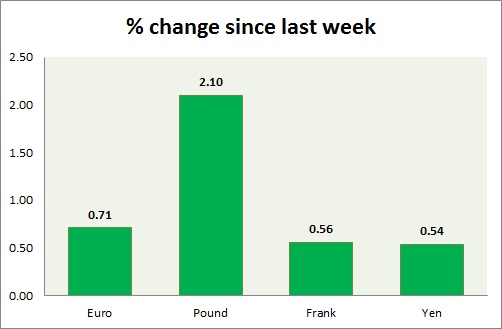

Strength meter (since last week) - Euro +0.71%, Franc +0.56%, Yen +0.54%, GBP +2.10%

EUR/USD -

Trading at 1.133

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.106, Immediate - 1.118-1.115

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.14-1.145

Economic release today -

- Special Euro zone leaders' summit is scheduled for Monday.

- Euro zone current account balance came at €22.3 billion in April.

Commentary -

- Euro would be very bullish if a resolution gets reached with creditors on Monday.

GBP/USD -

Trading at 1.588

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512, Immediate - 1.548-1.545

Resistance -

- Long term - 1.592-1.616, Medium term - 1.595, Short term - 1.595

Economic release today -

- Public sector net borrowing came at £ 9.3 billion in May.

Commentary -

- Pound is the best performer this week, gave up some gains today over profit booking.

USD/JPY -

Trading at 122.7

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy support

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 119, Immediate - 122.2-122.6

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 127.5. Immediate - 123.4

Economic release today -

- BOJ maintained monetary policy today.

Commentary -

- Yen is the best performer today as investors preferred safety ahead of Greek summit.

USD/CHF -

Trading at 0.922

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.90

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- NIL

Commentary -

- Franc is also gaining from safety bids over Greek situation, especially against Euro.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary