Dollar index trading at 95.98 (-0.30%).

Strength meter (today so far) - Euro +0.80%, Franc +0.67%, Yen -0.85%, GBP +0.86%

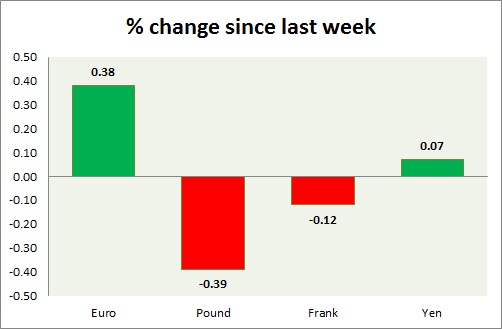

Strength meter (since last week) - Euro +0.38%, Franc -0.12%, Yen +0.07%, GBP -0.39%

EUR/USD -

Trading at 1.115

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.14-1.145, Immediate - 1.125-1.132

Economic release today -

- Greece submitted economic reforms, which might secure deal over weekend.

Commentary -

- Euro traded as high as 1.121 against dollar in anticipation of the deal, however gave up some of the gains as skepticism remains.

GBP/USD -

Trading at 1.55

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/sell

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512, Immediate - 1.53

Resistance -

- Long term - 1.592-1.616, Medium term - 1.595, Short term - 1.56

Economic release today -

- UK trade deficit shrank to lowest in two years to -£ 0.39 billion.

Commentary -

- Pound gained grounds as outlook and yields improved.

USD/JPY -

Trading at 122.7

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 119.7, Immediate - 122(broken)

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 127.5. Immediate - 123

Economic release today -

- Consumer confidence rose to 41.7 from 41.4 prior.

Commentary -

- Yen is again top loser today, as risk aversion subsided further. Deal on Greece might be close.

USD/CHF -

Trading at 0.941

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/buy support

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.90

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- NIL

Commentary -

- Franc gained along Euro over Greek deal, however Franc is likely to remain medium term sell against dollar.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings