Dollar index trading at 96.94 (-0.05%)

Strength meter (today so far) – Euro -0.06%, Franc +0.11%, Yen -0.31%, GBP -0.06%

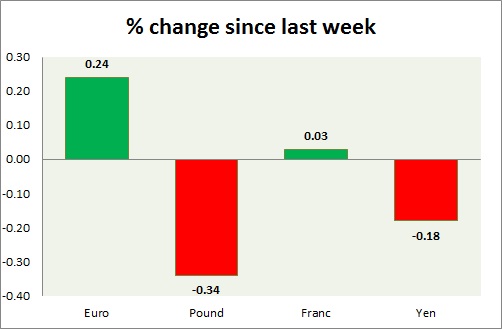

Strength meter (since last week) – Euro +0.24%, Franc +0.03%, Yen -0.18%, GBP -0.34%

EUR/USD –

Trading at 1.123

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range

Support

- Long term – 1.07, Medium term – 1.09, Short term – 1.10

Resistance –

- Long term – 1.16, Medium term – 1.14, Short term – 1.12 (broken)

Economic release today –

- Market manufacturing PMI improves to 57 in May and services PMI came at 56.2

Commentary –

- The euro remains upbeat thanks to weaker dollar and risk affinity.

GBP/USD –

Trading at 1.298

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.16, Medium term – 1.23, Short term – 1.27

Resistance –

- Long term – 1.32, Medium term – 1.305, Short term – 1.305

Economic release today –

- The UK Prime Minister Theresa May is scheduled to speak at 18:00 GMT.

Commentary –

- The pound remains dogged by the terrorist attack in Manchester. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 111.2

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range

Support –

- Long term – 109, Medium term – 110, Short term – 112 (broken)

Resistance –

- Long term – 119, Medium term – 115, Short term – 115

Economic release today –

- Nikkei manufacturing PMI came at 52 in April.

- All industry activity index declined by 0.6 percent in March.

Commentary –

- The yen’s performance improved on geopolitical tensions, but still red against the dollar so far.

USD/CHF –

Trading at 0.972

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98 (broken)

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- Trade balance came at 1.97 billion in April.

Commentary –

- Franc is up in line with the euro.