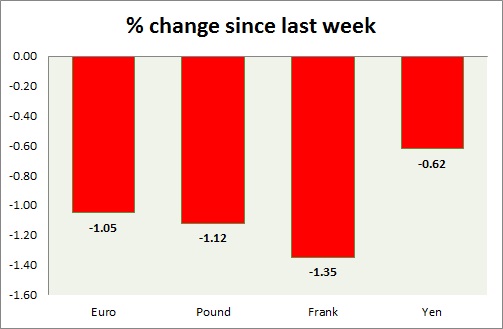

Dollar has further gained against the majors though the performance remained mixed (EUR, GBP, CHF, and JPY) this week. No major event risk scheduled for today. A chart and table is attached for explanation.

- Euro continues to lose ground against the dollar in today's trading after last night's fall. Today German retail sales data showed solid improvement 2.9% mom. That so far has failed to boost the Euro. Euro is expected to remain under pressure over ECB bond purchase and situation in Greece. Currently trading at 1.117. Immediate Support lies at 1.11 & Resistance 1.125.

- Pound is failing to perform this week despite improvement in economic dockets so far this week. Today construction PMI improved to 60.1. Seems like concerns started surfacing over the coming election as it might further push the rate hike. Pound is currently trading at support of 1.535 breaking that could prompt sharp fall. Immediate Support lies at 1.53, 1.52 & Resistance 1.545.

- Yen gained today over the official comments that the current pace of buying bonds by BOJ may not be increased further. Nevertheless BOJ is still printing at quick pace and could derail Yen further against the dollar in coming months. Until then range is here to stay. Currently trading at 119.8. Immediate Support lies at 118.2 & Resistance 120.5.

- Franc lost further ground against dollar as the positive GDP at 1.9% YoY failed to boost the currency. Current GDP print is not a good reflector of the massive revaluation in January and pain may be felt ahead in time. Currently trading at 0.96, moving towards its target sub 0.98. Immediate Support lies at 0.939 & Resistance 0.975.

|

Euro |

-0.24% |

|

Pound |

-0.52% |

|

Frank |

-0.83% |

|

Yen |

-0.10% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand