Dollar index trading at 95.62 (-0.35%).

Strength meter (today so far) - Euro +0.22%, Franc +0.26%, Yen +0.95%, GBP -0.34%

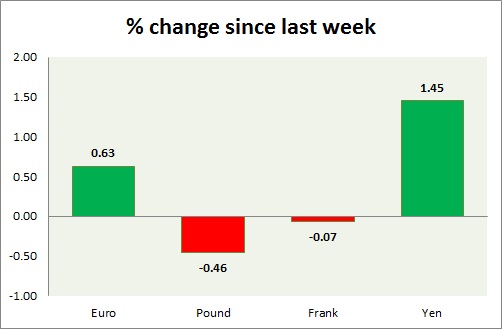

Strength meter (since last week) - Euro +0.63%, Franc -0.07%, Yen +1.45%, GBP -0.46%

EUR/USD

Trading at 1.125

Trend meter

- Long term - Buy, Medium term - Range, Short term - Range

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance

- Long term - 1.175-1.18, Medium term - 1.172, Short term - 1.163, Immediate - 1.132

Economic release today

- Euro zone unemployment rate dropped to 10.9%, lowest level in more than three years

Commentary

- Euro has reached initial target of 1.12 and now consolidating around that level. 1.13 area proving to be crucial.

GBP/USD

Trading at 1.531

Trend meter

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512,

Resistance

- Long term - 1.592-1.616, Medium term - 1.595, Short term - 1.58

Economic release today

- Manufacturing PMI contracted further to 51.5 in August from 51.9 in July.

Commentary

- Pound is the worst performer this week, currently challenging key support at 1.53 area. Further decline is possible.

USD/JPY

Trading at 119.9

Trend meter

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Sell

Support

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118

Resistance

- Long term - 130, Medium term - 127.5, Short term - 124.5

Economic release today

- PMI for manufacturing dropped to 51.7 in August from 51.9 in July.

Commentary

- Yen is the best performer this week as stock market rout renewed.

USD/CHF

Trading at 0.962

Trend meter

- Long term - Buy, Medium term - Range, Short term - Range

Support

- Long term - 0.88, Medium term - 0.90, Short term - 0.93

Resistance

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today

- PMI rose to 52.2 in August from 48.7 in July.

Commentary

- Franc benefiting from haven flows today as risk aversion returned in the market.

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight

Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight  Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target

Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target  The strikes on Iran show why quitting oil is more important than ever

The strikes on Iran show why quitting oil is more important than ever