Dollar index trading at 95.20 (-0.41%).

Strength meter (today so far) - Euro +0.32%, Franc +0.57%, Yen -0.16%, GBP +0.98%

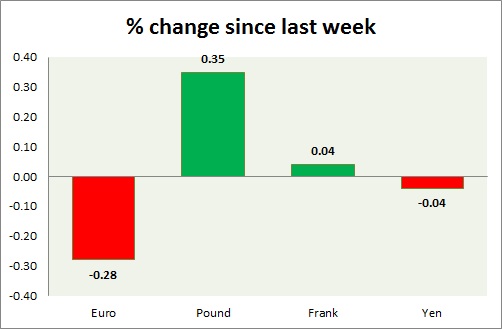

Strength meter (since last week) - Euro -0.28%, Franc +0.04%, Yen -0.04%, GBP +0.35%

EUR/USD -

Trading at 1.13

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.15, Short term - 1.15

Economic release today -

- Consumer price index rose by 0.1% for headline and 0.9% for core in August.

Commentary -

- Euro dropped sharply after Euro zone inflation data, however jumped back sharply as US inflation surprised to downside. Focus is on FOMC tomorrow.

GBP/USD -

Trading at 1.549

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512,

Resistance -

- Long term - 1.592-1.616, Medium term - 1.585, Short term - 1.543-1.545 (broken)

Economic release today -

- ILO unemployment rate dropped to 5.5% for three months to August. Wage growth came at 2.9% both including and excluding bonus.

Commentary -

- Pound is the best performer today and this week as it employment data came better than expected as BOE officials reiterated their positive views in parliamentary testimony. Active call - Sell Pound targeting 1.44 area with stop loss around 1.58 area.

USD/JPY -

Trading at 120.6

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 124.5

Economic release today -

- Trade balance scheduled for release at 23:50 GMT.

Commentary -

- Yen lost further grounds as risk favoring gained further and S&P downgraded Japan. Active call - Sell USD/JPY targeting 114.7 area with stop loss around 122

USD/CHF -

Trading at 0.968

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.93

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- ZEW survey showed expectations rose to 9.7 in September from 5.9 in August.

Commentary -

- Franc gained today from broad based Dollar weakness.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand