Dollar index trading at 96.27 (-0.01%).

Strength meter (today so far) - Euro -0.08%, Franc -0.36%, Yen +0.07%, GBP +0.26%

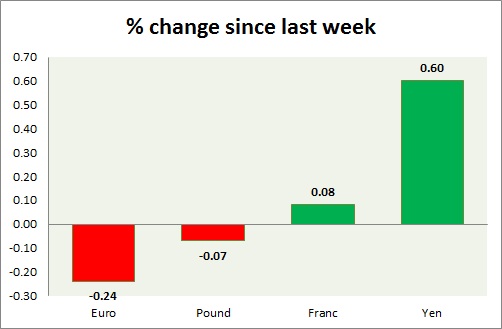

Strength meter (since last week) - Euro -0.24%, Franc +0.08%, Yen +0.60%, GBP -0.07%

EUR/USD -

Trading at 1.116

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085, Immediate - 1.109

Resistance -

- Long term - 1.175-1.18, Medium term - 1.15, Short term - 1.132

Economic release today -

- Euro zone PMI came at 52 for September.

Commentary -

- Euro is worst performer today, as expectations of ECB's further easing weighing on single currency.

GBP/USD -

Trading at 1.516

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512,

Resistance -

- Long term - 1.592-1.616, Medium term - 1.585, Short term - 1.572, Immediate - 1.524-1.526

Economic release today -

- UK manufacturing PMI slipped further to 51.5 in September from 51.6 in August.

Commentary -

- Pound recovered from major slump, might gain further as the currency at critical support level. Active call - Sell Pound targeting 1.44 area with stop loss around 1.58 area.

USD/JPY -

Trading at 119.8

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range

Support -

- Long term - 113.7-112.9, Medium term - 116-115, Short term - 118.6

Resistance -

- Long term - 130, Medium term - 126, Short term - 121.7, Immediate - 120.5

Economic release today -

- PMI rose to 51 in September from 50.9 in August.

Commentary -

- Yen is well bid, in spite of broad based gains inequity markets suggesting continued risk aversion. Active call - Sell USD/JPY targeting 114.7 area with stop loss around 122.

USD/CHF -

Trading at 0.977

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.93

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- Real retail sales dropped -0.3% in August for 12 months.

- PMI for September came at 49.5, down from 52.2 in August.

Commentary -

- SNB offers are likely given Franc's weakness today. Franc is worst performer today. Active Call - Buy USD/CHF with target around 1.03 area and stop around 0.95 area.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate