Dollar index trading at 95. 47 (-0.63%).

Strength meter (today so far) - Euro +0.68%, Franc +0.74%, Yen +0.20%, GBP +0.50%

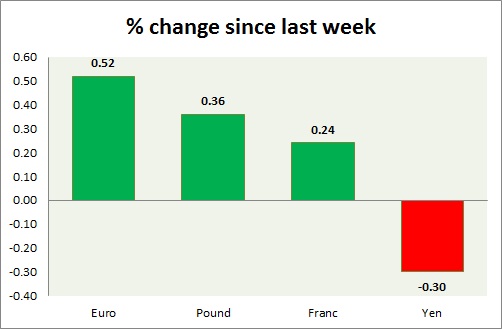

Strength meter (since last week) - Euro +0.52%, Franc +0.24%, Yen -0.30%, GBP +0.36%

EUR/USD -

Trading at 1.12

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085, Immediate - 1.109

Resistance -

- Long term - 1.175-1.18, Medium term - 1.15, Short term - 1.132

Economic release today -

- NIL.

Commentary -

- Euro continuing its consolidation in range of 1.11 to 1.132..

GBP/USD -

Trading at 1.517

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512,

Resistance -

- Long term - 1.592-1.616, Medium term - 1.585, Short term - 1.572, Immediate - 1.524-1.526

Economic release today -

- Halifax house prices dropped by -0.9% in September from August, still up 2% for the third quarter and 8.6% in last 12 months.

- BRC shop price index to be released at 23:00 GMT.

Commentary -

- Pound gained over weak Dollar, however struggling to maintain gains above 1.523 area. Active call - Sell Pound targeting 1.44 area with stop loss around 1.58 area.

USD/JPY -

Trading at 120.3

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range

Support -

- Long term - 113.7-112.9, Medium term - 116-115, Short term - 118.6

Resistance -

- Long term - 130, Medium term - 126, Short term - 121.7, Immediate - 120.5

Economic release today -

- BOJ to announce policy tomorrow in Asian hours.

Commentary -

- Yen is focused on BOJ monetary policy tomorrow. Active call - Sell USD/JPY targeting 114.7 area with stop loss around 122.

USD/CHF -

Trading at 0.975

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.93

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- Consumer price index still down -1.4% in September.

Commentary -

- Franc is struggling to break free of 0.98 resistance area. Active Call - Buy USD/CHF with target around 1.03 area and stop around 0.95 area.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand