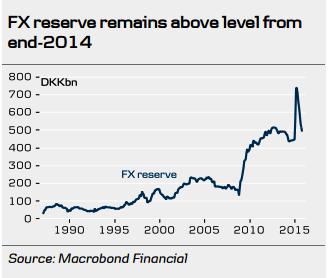

In October, Denmark's FX reserves declined to DKK492bn, from DKK514bn in September. DKK10bn of the decline was due to DN purchasing DKK in FX intervention.

The remainder was due to repayment of government foreign debt. Since April, DN has purchased DKK in FX intervention for DKK223bn, which has brought the FX reserve closer to the level from last year of around DKK450bn.

However, the pace of FX intervention slowed in October compared with September, where FX intervention totalled DKK22bn. The ECB is likely to cut its deposit rate by 10bp to minus 0.30% and expand its bond purchase programme to DKK75bn at its next meeting in December.

"DN might keep all its policy rates unchanged, i.e. the rate of interest on certificates of deposit is likely to stay at minus 0.75%, the current account rate at 0.00% and the lending rate at 0.05%", added Danske Bank.

Denmarks Nationalbank likely to stay on hold

Wednesday, November 4, 2015 4:04 AM UTC

Editor's Picks

- Market Data

Most Popular

Japan Nominates Reflationist Economists to BOJ Board, Signaling Policy Shift

Japan Nominates Reflationist Economists to BOJ Board, Signaling Policy Shift  Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom

Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom  Australian Central Bank Signals Tough Stance as Inflation Pressures Persist

Australian Central Bank Signals Tough Stance as Inflation Pressures Persist  RBNZ Signals Potential Interest Rate Hike as Inflation Outlook Remains Uncertain

RBNZ Signals Potential Interest Rate Hike as Inflation Outlook Remains Uncertain  Bain Capital Secures RBI Approval to Acquire Up to 41.7% Stake in Manappuram Finance

Bain Capital Secures RBI Approval to Acquire Up to 41.7% Stake in Manappuram Finance