A turbulent year for emerging markets (EM) may be coming to an end, but on the other hand, prospects for 2016 do not look very appealing either. Most economists expect either a slight recovery in average emerging market (EM) GDP growth, or at least a stabilisation at around 2015 levels. The forecasts mainly reflect stabilization in Russia, whereas activity in Brazil is seen sinking further into the doldrums.

EM external debt crisis seems unlikely, sovereign indebtedness is estimated to grow more modestly, allaying worries over an external sovereign debt crisis. EM non-financial debt has increased by some 45pp of GDP over the past five years to 160% on the back of super easy monetary policy in the DM world.

"At best, debt trends are set to flatten out, turning off a major engine of EM capex (and global growth). At worst, the rise in corporate defaults, already in the making, will start to lead EM corporate spreads wider", notes Societe Generale in a report.

To get over a potentially disorderly CNY depreciation, EM corporate leverage is very significant. AxJ leverage has built up most, and not just in local currency but also in US dollars. Deleveraging may thus cause capital outflows, but will tend to support easier monetary policy in the region to support growth.

Roots of EM crises have most often been in credit booms and currency overvaluation. EM corporate spreads have so far been well behaved, on the back of government support in China and the quest for return. If this were to be the next shoe to drop, the whole EM complex will stay wobbly.

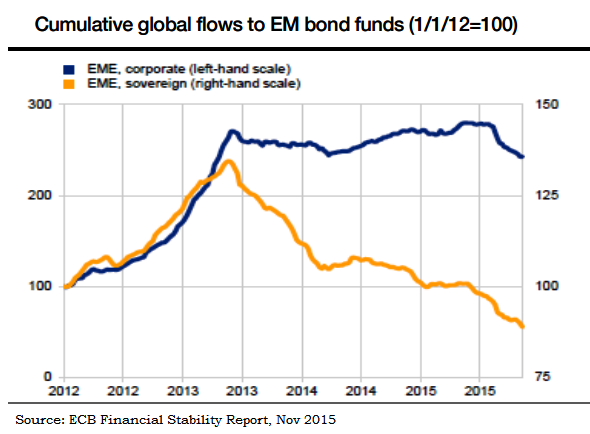

However economic stabilisation may be enough to lift cheaply valued EM assets. Volatility in EMs assets may stay high going into the new year, with allocations now slightly below their 2008-15 average, both for bonds and equities. In some cases, however, like EM corporate bonds, foreign allocations have only slightly retreated from the 2009-13 boom.

De-leveraging under way for Asia Ex-Japan

Wednesday, December 9, 2015 11:55 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary