Strong US economic dockets further fuelling the Dollar run and yields push as possibilities of a rate hike seems imminent.

Currency segment -

- Dollar index pushed to further heights over strong ADP payroll and PMI numbers. Dollar index currently trading above 96.

- Euro broke into fresh lows against the dollar and reached as low as 1.1060 in intra day trading.

- Pound failed to maintain its head above the support of 1.535 and broken sharply to 1.5263.

- Franc continued its weakness and moved further towards 0.965

- Aussie and Kiwi failed to break above resistance.

- USD/CAD fell over BOC comments but still above support.

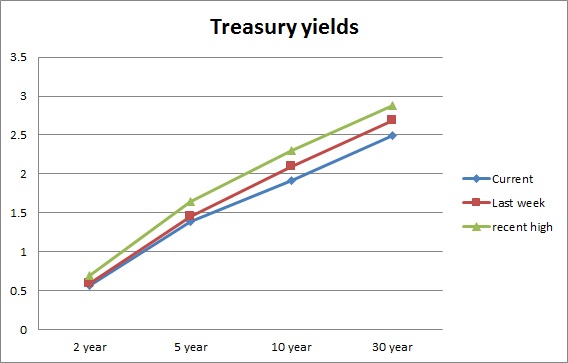

Treasury segment -

- FED's Evans expressed concern over inflation and rate rise in June today but the yields have strengthen significantly but still not pricing a rate hike in June. So there still exist potential for rate rise.

- 2 year yields have broken above the resistance at 0.60 levels and currently trading at 0.68. Further rise is possible over NFP report.

- The longer end of the curve is steepening showing conviction over the central bank's success to bring about inflation.

These developments may continue still further if the economy continues to maintain strength.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings