Series of the US data including IP, consumer confidence and retail sales numbers have disappointed the streets while unemployment rate was at 5.4% which was the slowest since 2008. Dollar showing weakness has been major cause of concern for actively trading commodities like crude oil, gold etc. So, what else can put a pause to this dollar's slump? Dollar gaining strength back on pounds is good sign while USDJPY is still range bounded and sideways. Today the two significant events are on calendar.

FOMC member Evans speech: Federal Reserve Bank of Chicago President and Federal Open Market Committee (FOMC) voting member Charles Evans is to speak. FOMC members are responsible for setting the benchmark interest rate and their speeches are closely watched for indications on the future possible direction of monetary policy. His comments may determine a short-term positive or negative trend.

NAHB Housing Market Index: The current forecast is at 57 while previous reading was at 56. The National Association of Home Builders' (NAHB) HMI rates the relative level of current and future single-family home sales. The data is compiled from a survey of around 900 home builders. A reading above 50 indicates a favorable outlook on home sales; below indicates a negative outlook. A higher than expected reading should be taken as positive/bullish for the USD, while a lower than expected reading should be taken as negative/bearish for the USD.

Six month's bill auction: 6 Month Bill Yield in the United States increased to 0.09 percent in May of 2015 from 0.06 percent in April of 2015. This is reported by the Federal Reserve.

Technicals and Derivatives Watch: (AUD/USD)

On daily charts signals clear signal of downtrend in this pair which means US dollar gaining strength as high volumes seen on spot trades while stochastic that observes where the most recent closing price is in relation to the price range for a chosen time period. We used slow stochastic to avoid too much noise and to have a smooth curve which evidenced %K line crossover exactly at 80 levels. So, overbought situation is seen in conformity with RSI (14) converging the downward price curve.

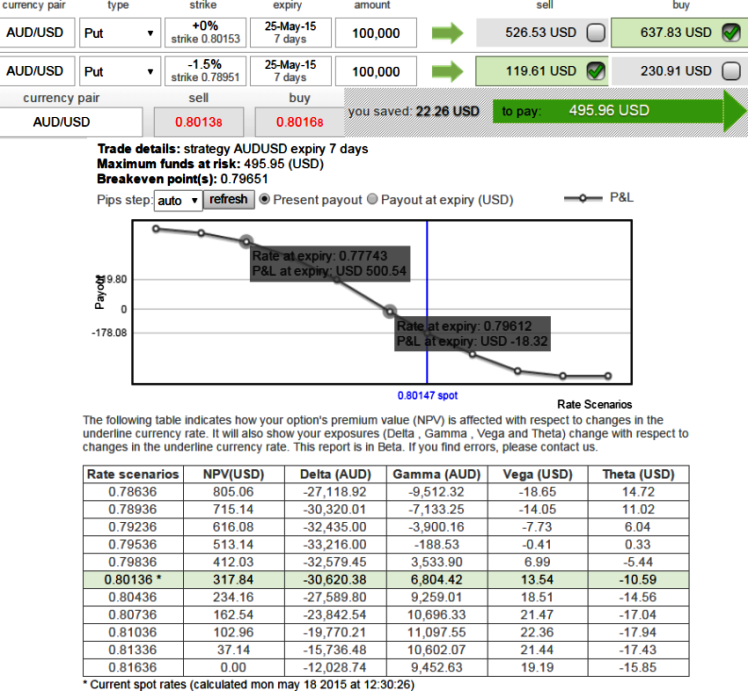

As a medium term perspectives, we would like to recommend the strategy for a probable bearish trend that would hedge the potential downside forex risk.

Option strategy: Bear Put Spread

The strategy reads this way, buy a Put option and sell another Put at a lower strike price (usually OTM) for a net debit.

Use this strategy over a long Put when Puts are overpriced or costlier or the underlying currency is only expected to move marginally lower.

Dollar struggling on series of weak economic data but gains on Aussie dollar; safeguard with BCS

Monday, May 18, 2015 7:14 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings