Dovish comments and forecasts have pushed the dollar lower against most of its trading counterparts, however it gained back some losses so far this week.

- However, FED has been quite successful in pushing back the interest rate expectation and increase the volatilities in the treasury and currency market.

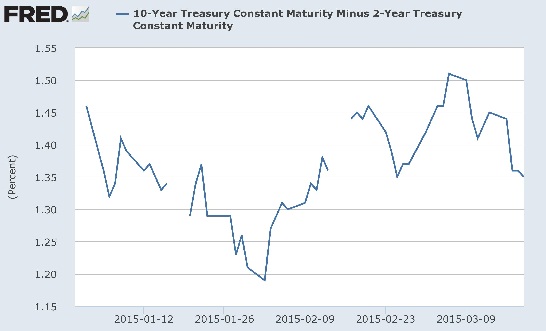

- The chart is prepared in FRED dash board of St. Louis FED. Yield difference between 10 year and 2 year treasury fell to 1.29% compared to 1.51% reached in early March.

- Before the last FOMC minutes participants kept consistency about rate hike that finally saw the differential rise from 1.19% in February to 1.51% in March. However, rapid rise of Dollar along made the participants somewhat worried.

Chicago FED Chief Charles Evans today expressed his desire for a rate hike in 2016 rather than this year and mentioned current low level of unemployment rate is still at least 0.5% away from normal.

Mr. Evens is a voting member in FOMC this year. Real question is will the dovish camp grow inside FOMC?

- Given the low level of inflation FED might push the rate hike away, as it has a dual mandate to fulfil or it could go for just one rate hike this year against expectation of two.

Dollar bulls need to remain cautious as market may not have fully understood, how dovish FED can be, if needed. FED has clearly mentioned earlier that it would not mind falling behind the curve for some period.