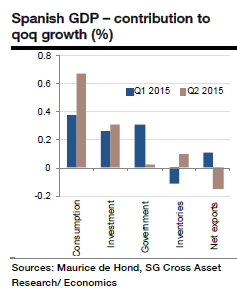

Spain household consumption (contributing for two-third of the Q2 growth number) continued to benefit from low interest rates (as the bulk of mortgage debt is in variable rates), low inflation, the ongoing tax reform and the improving labour market. INE is likely to confirm the 1.0% qoq GDP growth in Q2, says Societe Generale. The details will show that domestic demand explains the bulk of the growth in Q2.

Favourable financial conditions and lower taxes also supported the country's investment together with improved demand prospects. Net export is expected to have been broadly slightly negative in Q2. However, after a very strong H1, H2 and 2016 GDP growth is expected to slow down significantly - as many temporary factors (negative inflation in particular) will recede, says Societe Generale in a research note on Thursday.

On top of that, as both corporate and household indebtedness remain close to their pre-peak levels, the de-leveraging process is not over. As a result, the recent strong consumption and investment growth do not appear sustainable, adds SocGen. Finally, with the Catalonian regional elections in September and the national elections in late November, risks of political stalemate, uncertainty and lack of reform are elevated, weighing on businesses' hiring and investment decisions.

Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement

Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement  PBOC Scraps Forex Risk Reserve as Yuan Rally Pressures Chinese Exporters

PBOC Scraps Forex Risk Reserve as Yuan Rally Pressures Chinese Exporters  MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains

MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains  Gold Prices Surge Over 2% After U.S.-Israel Strikes on Iran Spark Safe-Haven Demand

Gold Prices Surge Over 2% After U.S.-Israel Strikes on Iran Spark Safe-Haven Demand  Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock

Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock  China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump

China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump  Australia Housing Market Hits Record High Despite RBA Rate Hike

Australia Housing Market Hits Record High Despite RBA Rate Hike  Asian Markets Slide as Nvidia Earnings, U.S.-Iran Tensions and AI Valuations Weigh on Investor Sentiment

Asian Markets Slide as Nvidia Earnings, U.S.-Iran Tensions and AI Valuations Weigh on Investor Sentiment  Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA

Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA  Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade

Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade  Bank of Japan Signals Further Interest Rate Hikes as Inflation Trends Toward 2% Target

Bank of Japan Signals Further Interest Rate Hikes as Inflation Trends Toward 2% Target