Hawks at European Central Bank (ECB) likely to give tough time to doves at this week's policy meeting, since improved economic data likely to strengthen their arguments.

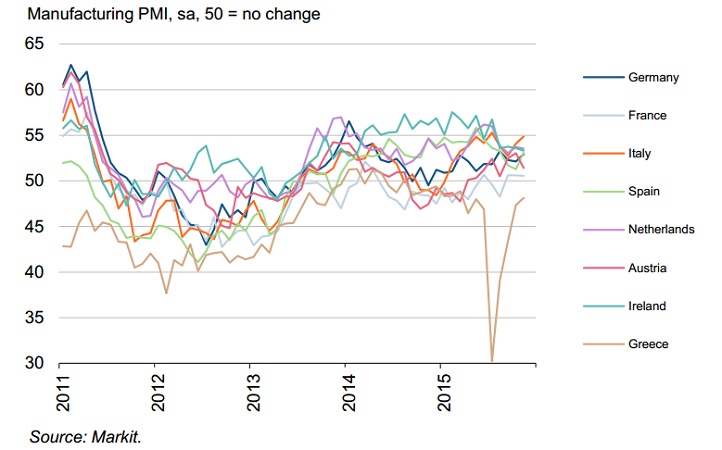

Latest data shows, that inflation has stopped declining and core inflation slowly creeping up. Latest report from Markit economics say that European manufacturing growth is way past the crisis.

- Italian manufacturing PMI rose to four month high at 54.9

- Spanish manufacturing PMI rose to 3 month high at 53.1

- German PMI rose to 3 month high at 52.9, beating flash PMI

- French manufacturing sector continues to grow in November, with PMI above 50 at 50.6

- Greek PMI touched 8 month high at 48.1 (still contracting but showing signs of life)

All is not rosy though,

- Irish PMI touched 21 month low at 53.3 (still high).

- Netherlands PMI toughed 2 month low at 53.5

- Austrian PMI dropped to 3 month low at 51.4.

Over Euro zone PMI at 52.8, indicating stronger growth in the region. Growth in production and new orders were reported in all nations.

Doves on the other hand likely to point out that so far it has been much of a jobless recovery and hiring has just started picking up. Disappointing from ECB's side might prove costly, since unemployment is still high at 10.7%.

Euro remains supressed despite weak Dollar, awaiting the ECB later in the week. Trading at 1.059 against Dollar.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty