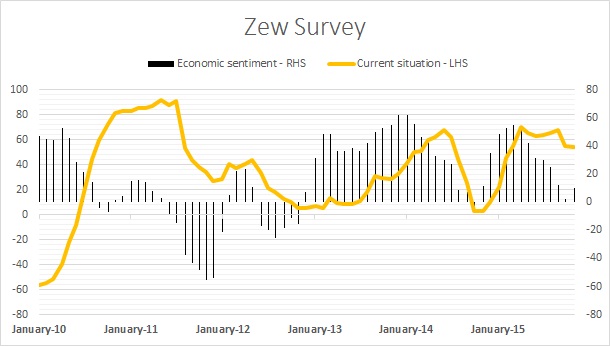

European Central Bank's (ECB) easing hint is doing its magic again through business community, which this have already been enjoying weaker Euro and improvement in domestic demand. Moreover, European Banks' survey indicated that banks are likely to use the additional fund from ECB's asset purchase program into lending and further cut in deposit rates would ease already declining interest rates further.

In Zew president, Professor Clemens Fuest's own words - "The outlook for the German economy is brightening again towards the end of the year. Economic pessimism appears not to have increased after the terror attacks in Paris. The currently high level of consumption in Germany, the recent decline in the external value of the euro, and the ongoing recovery in the United States are likely to bolster the robust development of the German economy."

In spite of recent turmoil and slowdown in global trade, it is more likely than not, that European bourses would perform better than their global market peers.

European blue chip index is currently trading at 3430, up 0.9% today and close to 10% for the year, compared to -0.5% YTD decline in S&P500.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says