Can the below events draw EURGBP's slumps to a halt..? Any which ways we suspect.

- ECB Monetary Policy Meeting that details the complete record of the ECB Governing Board's most recent meetings and shed lights on economic conditions.

- ECB President Draghi Speech

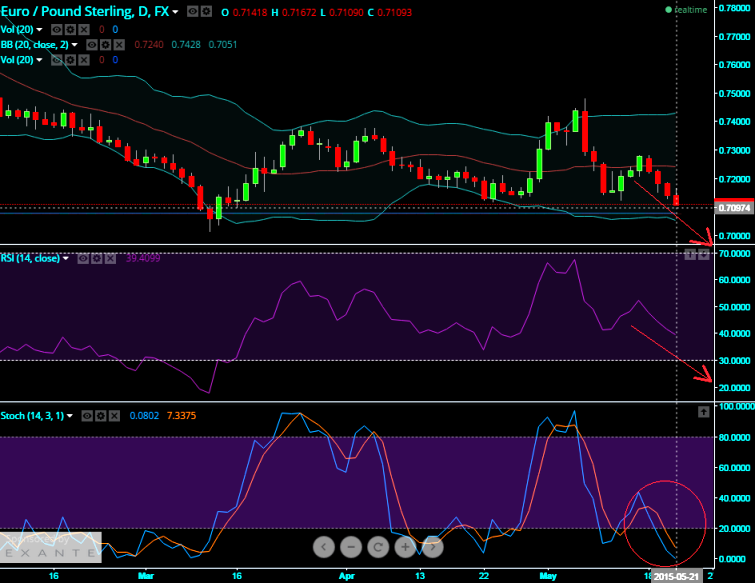

Both on weekly and daily charts no oscillating indicators suggesting recovery of recent losses as both RSI (14) and stochastic moves in downward convergence.

EUR/GBP has breached a crucial support at 0.7128 so as to indicate the near term downswings, we foresee dips until 0.7058

The resistance is figured out at around 0.7181 levels and any bullish signs can be spotted only above this level.

Option basket: Write a covered put (EURGBP)

As EURGBP pair is deemed as further declines, we advocate writing of naked put options while shorting the compelled exchange rate of the underlying currency on spot.

This strategy offers limited returns with no downside risks.

Profit for the covered put option strategy is limited and maximum gain is equal to the premium received for the writing put option.

Caution: As the writer is short on the underlying spot currency, the unlimited risk is associated when the exchange rate of this underlying currency spikes up significantly.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings