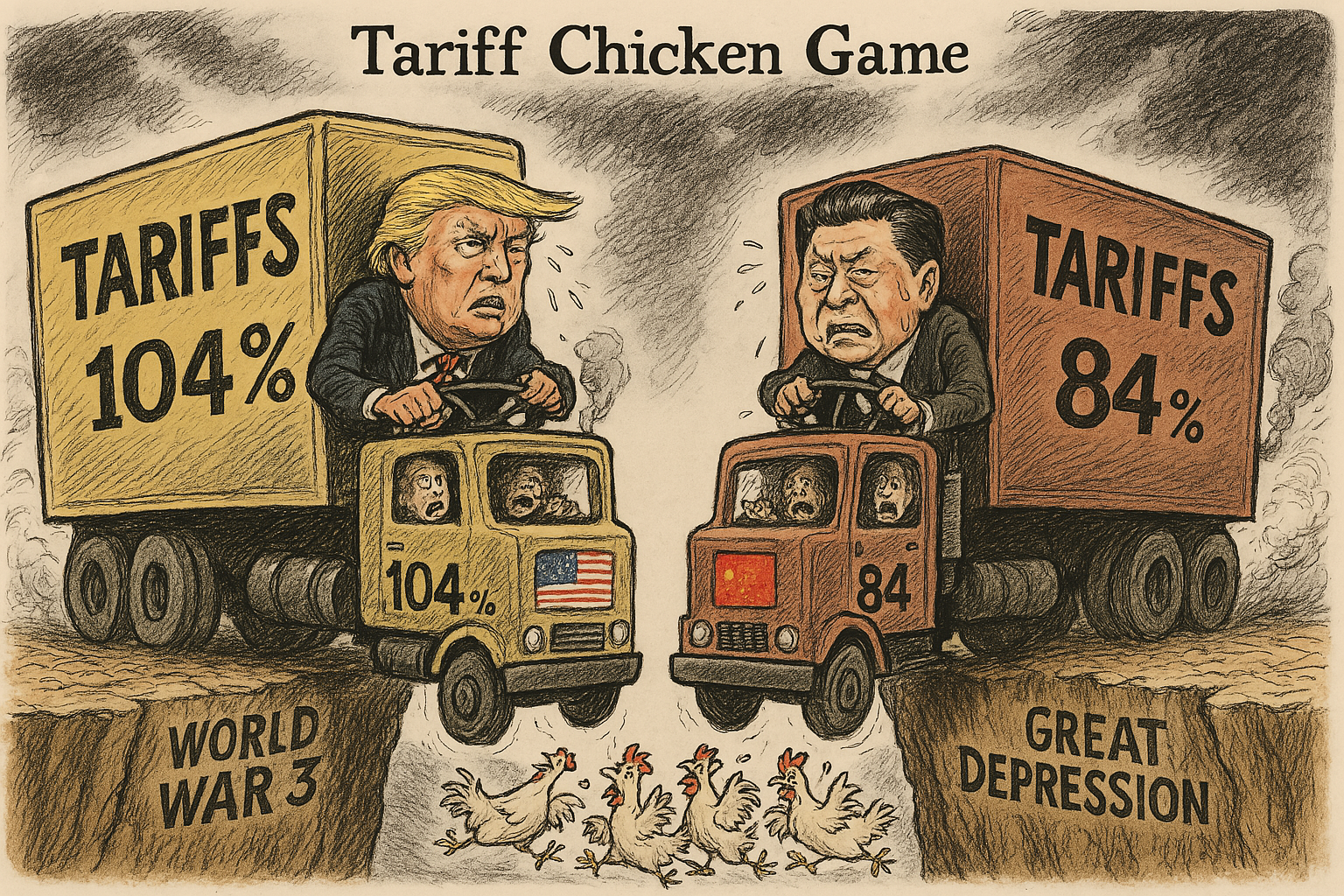

Amid rising tensions in the U.S.-China trade war, this week’s editorial cartoon depicts a dramatic “chicken game” scenario, where two economic superpowers appear locked in a collision course with potentially devastating global consequences.

In the illustration, U.S. President Donald Trump and Chinese President Xi Jinping are shown driving massive trucks labeled “TARIFFS” directly toward one another. Emblazoned on the vehicles are the stark figures “104%” and “84%,” symbolizing the steep tariffs recently announced by both countries. The road they travel leads to the edge of a cliff—ominously marked “WORLD WAR 3” and “GREAT DEPRESSION.”

Both leaders grip the wheel with sweat-streaked tension, unwilling to yield, while their panicked aides scream from the passenger seats. The metaphor is clear: this is not just a dispute over trade policy—it is a full-scale confrontation with global ramifications.

The image underscores how the tariff war risks spiraling far beyond economic retaliation. With global inflation, disrupted supply chains, and rising geopolitical instability already shaking markets, a full-blown escalation could lead to a scenario as catastrophic as a third world war or a repeat of the 1930s Great Depression.

The cartoon poses a sobering question: Who will blink first? But more importantly, it asks—if no one backs down, is there even a winner in this game?

Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit

Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit  USITC to Review Impact of Revoking China’s PNTR Status, Potentially Raising Tariffs on Chinese Imports

USITC to Review Impact of Revoking China’s PNTR Status, Potentially Raising Tariffs on Chinese Imports  Apple Surpasses Microsoft to Reclaim Title as World's Most Valuable Company

Apple Surpasses Microsoft to Reclaim Title as World's Most Valuable Company  Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand

Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand  Tech Stocks Surge in Asia; Experts Warn ‘Cooling AI Boom May Hit NVIDIA’s Gains Hard’

Tech Stocks Surge in Asia; Experts Warn ‘Cooling AI Boom May Hit NVIDIA’s Gains Hard’  Japan Nominates Reflationist Economists to BOJ Board, Signaling Policy Shift

Japan Nominates Reflationist Economists to BOJ Board, Signaling Policy Shift  Tech Stocks Resilient Amid Bond Market Pressure and AI Boom

Tech Stocks Resilient Amid Bond Market Pressure and AI Boom  China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump

China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump  U.S. Stocks Close Lower as Hot PPI Data, Nvidia Slide Weigh on Wall Street

U.S. Stocks Close Lower as Hot PPI Data, Nvidia Slide Weigh on Wall Street  Tesla, Apple, Nvidia Boost Nasdaq to Record High as Jobs Report Ignites Fed Rate Cut Hopes

Tesla, Apple, Nvidia Boost Nasdaq to Record High as Jobs Report Ignites Fed Rate Cut Hopes  PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation

PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation  Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute

Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute