Asian stock markets started the week on a strong note, buoyed by tech sector gains as anticipation builds around key economic decisions in China and Japan. Despite the positive momentum, analysts caution that the ongoing cooling of the artificial intelligence (AI) frenzy could dampen earnings for major players like NVIDIA Corporation.

China’s Economic Stimulus Fails to Impress Investors

China’s Shanghai Composite and Shenzhen Component indices struggled to keep pace with regional gains, fluctuating between slight losses and flat performance. Market participants are closely watching the People’s Bank of China’s (PBoC) upcoming decision on the Loan Prime Rate (LPR), set to be announced later this week. Economists widely predict the central bank will maintain rates, following an October cut.

Investor sentiment toward China remains lukewarm as recent economic stimuli from Beijing have failed to make a noticeable impact. October inflation data revealed disinflationary pressures persist, leaving markets uncertain about the country’s near-term economic recovery. Additionally, key speeches by top Chinese officials at a Hong Kong conference are expected to provide further insight into potential policy measures.

Hong Kong’s Hang Seng Index edged higher, gaining 0.4% thanks to strength in technology stocks. However, Xiaomi Corp weighed on the broader market with a 2% drop after reporting losses in its electric vehicle division despite improving overall earnings.

Japanese Tech Stocks Propel Nikkei Higher

Japan’s Nikkei 225 and Topix indices both rose by 0.4%, bolstered by gains in tech shares and the yen’s continued weakness, which provided support to export-driven sectors. Investors are bracing for Japan’s October Consumer Price Index (CPI) data, due Friday, which could offer clues about the country’s economic trajectory. Last week’s disappointing GDP data, showing a sharp slowdown in third-quarter growth, heightened concerns about the nation’s recovery momentum.

Broader Asian Markets Follow Tech Rally

South Korea’s KOSPI index mirrored the regional optimism, rising 0.2%, driven by strong performances from local tech stocks. Meanwhile, Australia’s ASX 200 outperformed its peers with a 1.1% surge, fueled by robust gains in mining and energy sectors, as commodity prices rallied globally.

India’s Nifty 50 futures indicated a positive start to the day, offering some relief after steep corrections pushed the benchmark into a 10% slump from recent record highs. Indian markets are looking for stability after weeks of volatility.

NVIDIA Earnings Under Spotlight Amid AI Market Concerns

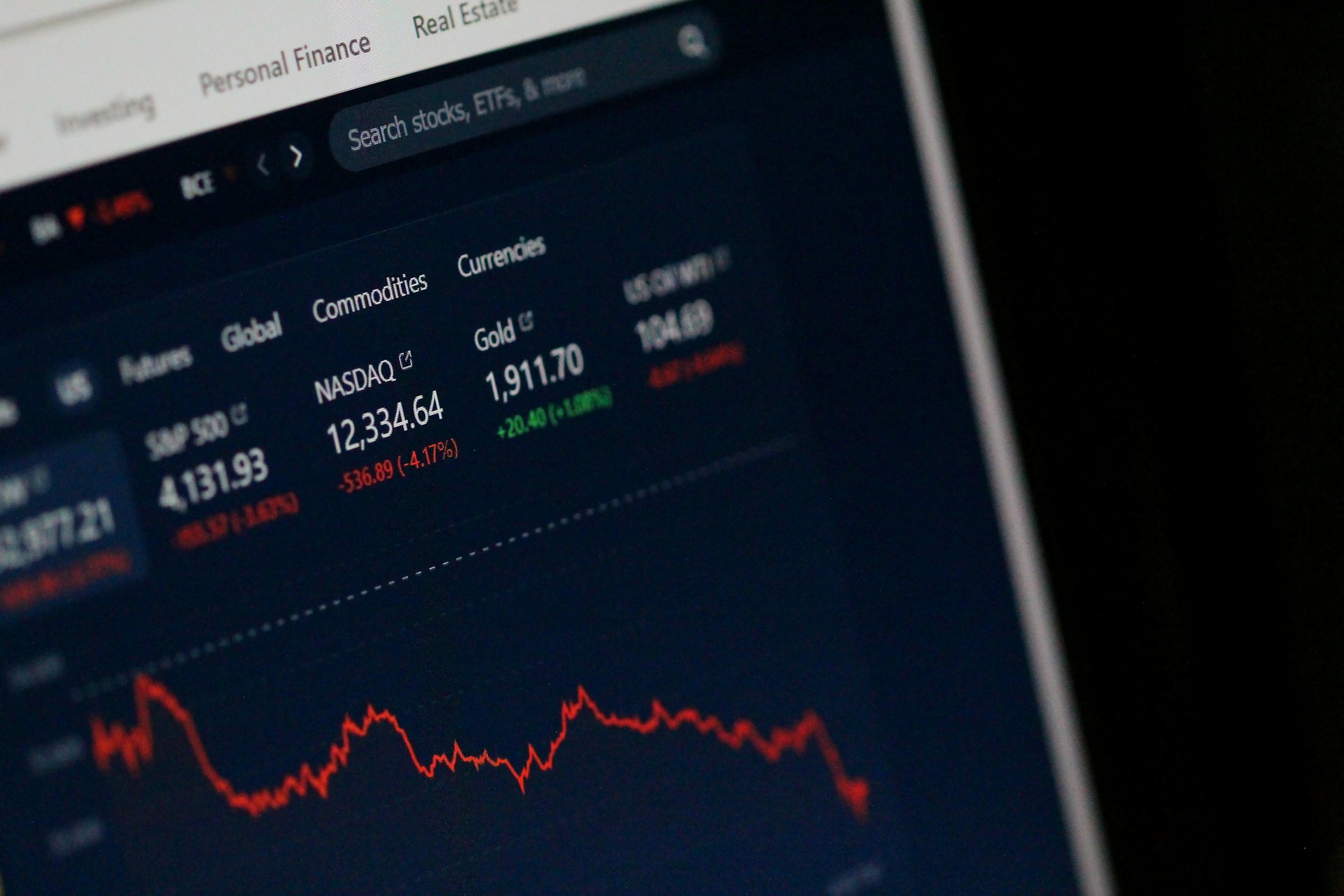

The rally in Asian tech stocks was partly inspired by Wall Street’s overnight gains, with U.S. futures holding steady during Asian trading hours. All eyes are now on NVIDIA’s earnings report this week, which could set the tone for the future of the AI boom. With concerns mounting over cooling interest in AI-driven stocks, analysts have questioned whether the company’s valuation can sustain further growth. NVIDIA’s performance will serve as a bellwether for investor confidence in the sector.

S&P 500 Rises Amid Cyclical Stock Gains, Inflation Data Looms

S&P 500 Rises Amid Cyclical Stock Gains, Inflation Data Looms  IMF Warns Japan of Market Volatility and Interest Rate Risks

IMF Warns Japan of Market Volatility and Interest Rate Risks  Dominican Republic Unveils Massive Rare Earth Deposits to Boost High-Tech and Energy Sectors

Dominican Republic Unveils Massive Rare Earth Deposits to Boost High-Tech and Energy Sectors  Global Currency Shifts After BOJ Rate Hike and Trump's Tariff Comments

Global Currency Shifts After BOJ Rate Hike and Trump's Tariff Comments  U.S. Stock Futures Fall as Nvidia Drops Despite Strong Earnings; Netflix Jumps 9%

U.S. Stock Futures Fall as Nvidia Drops Despite Strong Earnings; Netflix Jumps 9%  Teladoc Shares Rise on Amazon Collaboration for Health Programs

Teladoc Shares Rise on Amazon Collaboration for Health Programs  China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump

China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump  Trump Touts Stock Market Gains and 401(k) Boost Amid Tariff Uncertainty

Trump Touts Stock Market Gains and 401(k) Boost Amid Tariff Uncertainty  Trump to Impose Oil and Gas Tariffs by Feb. 18, Easing Canadian Crude Levy

Trump to Impose Oil and Gas Tariffs by Feb. 18, Easing Canadian Crude Levy  Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade

Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade  Oil Prices Steady as US-Iran Nuclear Talks and Rising Crude Inventories Shape Market Outlook

Oil Prices Steady as US-Iran Nuclear Talks and Rising Crude Inventories Shape Market Outlook  Tesla, Apple, Nvidia Boost Nasdaq to Record High as Jobs Report Ignites Fed Rate Cut Hopes

Tesla, Apple, Nvidia Boost Nasdaq to Record High as Jobs Report Ignites Fed Rate Cut Hopes  U.S. Stocks Hit Unprecedented Peaks Amid Growing Speculation of Federal Rate Cuts

U.S. Stocks Hit Unprecedented Peaks Amid Growing Speculation of Federal Rate Cuts  Global Currencies Stabilize as U.S. Tariff Uncertainty Persists

Global Currencies Stabilize as U.S. Tariff Uncertainty Persists  Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute

Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute  Asian Markets React to Tariff Reports and Fed Policy Shifts

Asian Markets React to Tariff Reports and Fed Policy Shifts  Jefferies Upgrades Safran Group Stock with Strong Growth Outlook

Jefferies Upgrades Safran Group Stock with Strong Growth Outlook