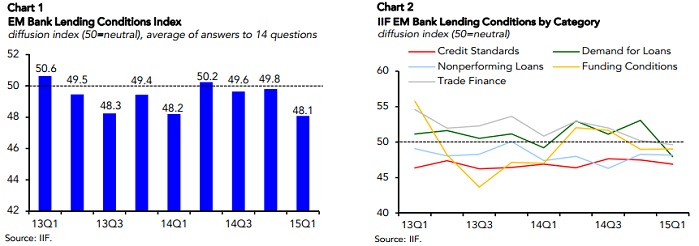

According to survey by Institute for International Finance (IIF), composite index for EM bank lending conditions dropped to 48.1 in first quarter of 2015, lowest level since fourth quarter of 2011.

- Major drop in overall condition was due to sharp deterioration in loan demand along with general tightening in credit condition.

- Supply of credit also remains tight as lenders remain cautious over the effects of first rate hike by US Federal Reserve this year. Situation have eased since March FOMC meeting.

- By region, Emerging Asia and Emerging Latin America led to overall tightening in lending conditions. Emerging Europe has also been facing somewhat tightening condition.

- Investors remain cautious over emerging markets relatively large share of non-performing assets in loan portfolio.

With large dollar debt exposure many of the emerging market companies especially in China, Turkey, Brazil remains vulnerable to rise of dollar and first rate hike by US federal Reserve.

One piece of good news is that, funding conditions has improved in emerging Asia due to series of rate cuts provided by countries' central banks and additional deposits. Emerging Asia funding index climbed 8.3% to 54.9.

India has attracted fresh new deposits driven by optimism over new government in power and Pradhan Mantri Jana Dhan Yojna scheme, however banks need to covert these additional deposits to loans for sustenance and growth in future.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand