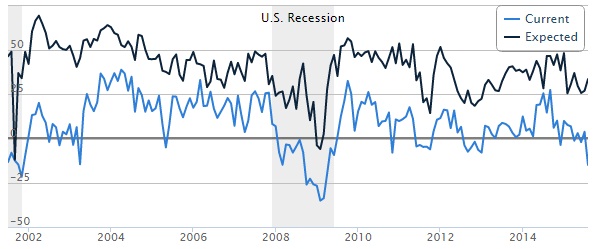

Empire state manufacturing survey dropped sharply in August to -14.92, lowest since 2008/09 crisis. While economists were expecting improvement to 5 from prior 3.86, the data was massive disappointment.

The concern is however not reflected by market participants. Initially Dollar lost ground after the release, however it has recovered since then. Market seem to be confident enough that this deterioration is unlikely to push FED to rethink hike.

Why may be so?

- Empire survey represents New York, whose economy is basically service driven and manufacturing forms a very small part compared to the nation.

- In spite of deterioration in empire survey, expectation for future has significantly improved to highest in six months.

- Since New York represents small faction in total US manufacturing, this slowdown might be due to local factors, in which case there could be sharp bounce back.

US Dollar index, which represents value of Dollar against basket of currencies is currently trading at 96.8, up 0.21% for the day.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?