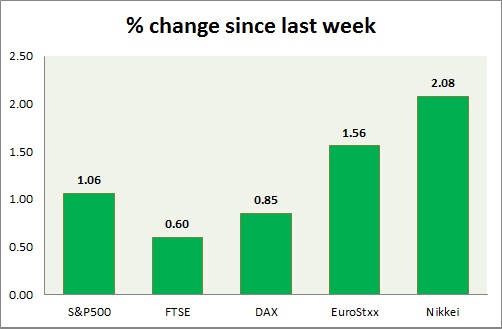

Equities are all mixed performer in today's trading. Kindly note all instruments mentioned here are CFDs, whose values might differ from cash or future traded. Performance this week at a glance in chart & table -

S&P 500 -

- S&P 500 is facing selling pressure since yesterday's hawkish speech by FED Chair Janet Yellen. However today holding up well. Today's range 2110-2090.

- S&P 500 might reach as high as 2170, if bulls are able to hold on to support around 2070 area.

- S&P 500 future is currently trading at 2102. Immediate support lies at 2120 and resistance 2070.

FTSE -

- FTSE is down in spite of dovish tone in BOE inflation reports. Growth concern probably weighing on stocks. Today's range 6420-6350.

- Next target for FTSE is around 5600 and then 5200. Upside target is coming around 6720.

- FTSE is currently trading at 6380. Immediate support lies at 6270, 6310 and resistance 6700, 6820.

DAX -

- DAX is up in line with European stocks. Today's range 10780-10960.

- DAX is currently trading at 10880. Immediate support lies at, 10,700, 9850 area and resistance at 11150, 11500 around.

EuroStxx50 -

- Stocks across Europe are green today.

- German DAX is up (+0.60%), France's CAC40 is up (+0.90%), Italy's FTSE MIB is down (-0.50%), Spain's IBEX is down (-0.15%).

- EuroStxx50 is currently trading at 3460, up by +0.52% today. Support lies at 3370, 3200 and resistance at 3550.

Nikkei -

- Nikkei is up thanks to support from Yen and global buying. Today's range 19000-19340

- Nikkei is currently trading at 19240, with support around 18650, 18000 and resistance at 19600, 20600.

|

S&P500 |

+1.06% |

|

FTSE |

+0.60% |

|

DAX |

+0.85% |

|

EuroStxx50 |

+1.56% |

|

Nikkei |

+2.08% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary