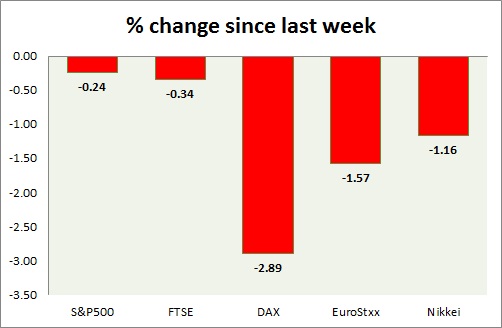

Equities are having a volatile week so far and today's performance is mixed across board. Performance this week at a glance in chart & table -

- S&P 500 - US benchmark has taken support at key level and squared off some of the losses. Initial jobless claims fell to 289,000 from previous 320,000. Retail sales declined by -0.6%. SPX500 is currently trading at 2062, up 0.87% for the day. Immediate support lies at 2040 and resistance 2068, 2081.

- FTSE - FTSE gained some ground but further losses might occur as key support level remains broken. BOE governor Mark Carney maintained stance of rate hike and RICS House price index improved further by 14%. FTSE is trading at 6778, up 0.85% for the day. Price pattern suggests the index might fall as low as 6560. Support lies at 6690 and resistance near 6860.

- DAX - DAX, best performer this month seems to be taking a breather today after inflation improved across Euro zone but industrial production lost steam. DAX is currently trading at 11787, down nearly 0.2% for the day. Immediate support lies at 11400.

- EuroStxx50 - Stock performance is mixed across Europe. Today looks like a profit booking day. Germany is down (-0.16%), France's CAC40 is down (-0.15%), and Italy's FTSE MIB is up (0.10%) whereas Spain's IBEX is up (0.10%). EuroStxx is currently trading at 3644, down -0.2% for the day. Support lies at 3555.

- Nikkei - Nikkei is best performer today as risk aversion diminished across globe. It surged more than 1.50% for the day. Nikkei has broken the resistance at 19000 in today's trading and might move towards its target of 20,800. Immediate support lies at 18640, 18500.

|

S&P500 |

-0.53% |

|

FTSE |

-1.56% |

|

DAX |

2.53% |

|

EuroStxx |

1.11% |

|

Nikkei |

1.72% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand