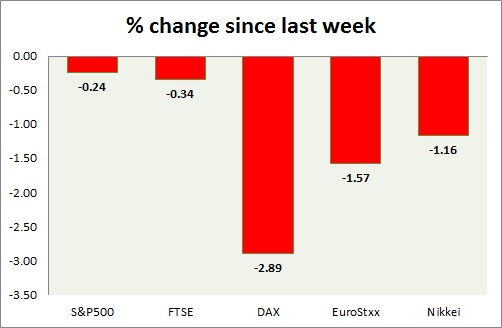

Equities cheered dovish comments from FOMC clearly indicating that monetary policies moving markets. Performance this week at a glance in chart & table -

- S&P 500 - US benchmark sailed back to gains after FOMC. It has broken key resistance level however giving up gains in today's trading. US current account balance worsened to $ -113 billion, initial jobless claims came at 291,000. Continuing claims was 2.417 million. Philadelphia manufacturing index slowed to 5 from previous 5.2. SPX500 is currently trading at 2090, down 0.50% for the day. Immediate support lies at 2040, 20160 and resistance 2120, 2164.

- FTSE - FTSE, is treading water near all-time highs, looks like will be testing the high over coming sessions. UK 10 year bond was auctioned at a higher 1.68% yield. FTSE is currently trading at 6950. Support lies at 6720 and resistance near 6965, 7010.

- DAX - DAX, is taking breather so far this week, hit by profit booking. FOMC comments filed to induce much of a rally. DAX is currently trading at 11840, down by 0.7% today. Immediate support lies at 11740, 11390.

- EuroStxx50 - Stocks across Europe hit by selling core and buying periphery. Germany is down (-0.70%), France's CAC40 is down (-0.27%), and Italy's FTSE MIB is up (0.51%) whereas Spain's IBEX is up (0.15%). EuroStxx50 is currently trading at 3656, flat for the day.

Support lies at 3635, 3545. - Nikkei - Nikkei is having a volatile session. Bulls are failing to keep gains above 19500. Stronger yen also dented mood. Nikkei might move towards its target of 20,800. Nikkei is trading at 19460. Immediate support lies at 19220, 18570.

|

S&P500 |

1.95% |

|

FTSE |

2.81% |

|

DAX |

-0.93% |

|

EuroStxx50 |

-0.41% |

|

Nikkei |

1.03% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings