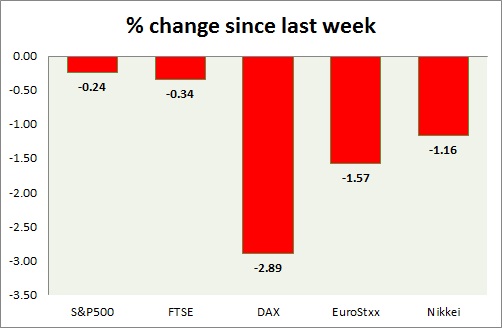

Today is a risk on day for global equities so far. Performance this week at a glance in chart & table -

S&P 500 -

- US benchmark successfully bounced back from key support last week and extended gains today.

- Personal income grew

better than expected at 0.4% in February. - Personal spending grew marginally at 0.1%.

- Core PCE price index remained stable growing at 1.4% YoY.

- Pending home sales grew 12% YoY and 3.1% mom in February.

- Dallas FED manufacturing business index fell further to -17.4 from prior -11.2

- SPX500 is currently trading at 2082, up 1% for the day. Immediate support lies at 1980, 2040 and resistance 2120, 2164.

FTSE -

- FTSE gained grounds today after last week's massive selloff. Risk favoring sentiment remains at large today.

- FTSE is currently trading at 6896, up 0.60% today. Immediate support lies at 6700 and resistance at 9665 and 7060.

DAX -

- DAX is top performer today, gaining on risk on theme. Improved sentiment readings across Euro zone improved sentiments towards European stocks as a whole.

- German CPI came weaker, prices grew 0.5% mom compared to 1% prior.

- DAX is trading at 12062, up near 1.6% today. Immediate support lies at 11750, 11600 and resistance at 12080, 12200.

EuroStxx50 -

- Stocks across Europe are positive today.

- Germany is up (+1.60%), France's CAC40 is up (+0.93%), Italy's FTSE MIB is up (+1.10%) and Spain's IBEX is up (+0.92%).

- EuroStxx50 is currently trading at 3726, up +1.20% today. Bias is upwards. Support lies at 3635, 3545.

Nikkei -

- Nikkei has rebounded from support and gaining today as risk favoring sentiment is on across globe. Weaker Yen also remains price supportive for the stock market as a whole.

- Nikkei is currently trading at 19588. Immediate support lies at 19220, 18540 and resistance at 19730, 19920.

|

S&P500 |

+0.97% |

|

FTSE |

+0.48% |

|

DAX |

+1.68% |

|

EuroStxx50 |

+1.20% |

|

Nikkei |

+1.18% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings