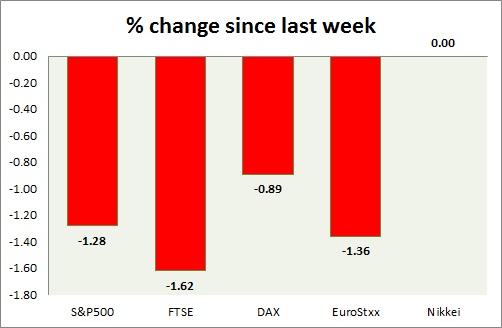

Global sell offs are driving equity prices lower today. Performance this week at a glance in chart & table -

S&P 500 -

- S&P has broken below 2100 once more to test the supports. 2080 area would provide some interim covering.

- MBA mortgage application dropped -4.6% last week.

- ADP employment disappointed once more adding 169,000 on payroll against median estimate of 200,000.

- Non-farm productivity dropped -1.9%.

- Unit labor cost rose to 5% in first quarter though it is a preliminary estimate.

- S&P 500 is currently trading at 2081, down -0.39% today. Immediate support lies at 1980, 2040 and resistance 2125, 2164.

FTSE -

- FTSE trading flat today, amid global sell offs. Improved business outlook keeping stocks relatively warm.

- UK services PMI rose to 59.5 in April, against median estimate of 58.5

- Focus is now on tomorrow's election outcome. Labour party's lead might trigger sell offs.

- FTSE is currently trading at 6920, down -0.1% today. Immediate support lies at 6700.

DAX -

- DAX is down further as rising bund yields have led to risk aversion in stocks.

- Larger trend remains upwards, however price might go down further in short term. Bearish engulfing in weekly chart remains at play. Bears have the potential to push prices as low as 10500.

- German Services PMI disappointed to 54 against expectation of 54.4. However growth still remains commendable in services sector.

- DAX is currently trading at 11280, down about 0.4% today. Immediate support lies at 10550 and resistance at 11740, 12080 around.

EuroStxx50 -

- Stocks across Europe are mixed today.

- Germany is down (-0.4%), France's CAC40 is down (-0.16%), Italy's FTSE MIB is up (+0.12%) and Spain's IBEX is up (+0.2%).

- Bears remain in control and might push lower.

- EuroStxx50 is currently trading at 3546, down -0.08% today. Support lies at 3450, 3300 and resistance at 3760

Nikkei -

- Nikkei is closed over holiday in Japan.

|

S&P500 |

-1.28% |

|

FTSE |

-1.62% |

|

DAX |

-0.89% |

|

EuroStxx50 |

-1.36% |

|

Nikkei |

+0.00% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings