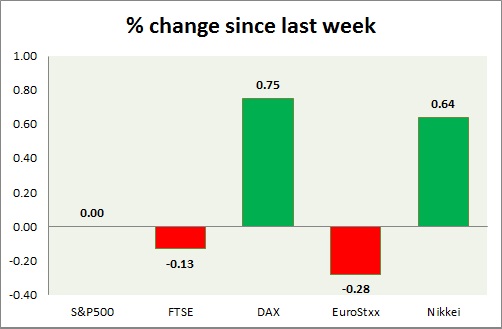

Equities are mixed in today's trading. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is trading close to all-time high. Further rise might be on card, however policy makers have been warning against high valuation in the stock market.

- NAHB house price index dropped to 54 from 56 prior.

- S&P 500 is currently trading at 2123. Immediate support lies at 1980, 2040 and resistance 2125, 2164.

FTSE -

- FTSE were once again resisted at 7000, dropped after making high around 7015.

- FTSE is currently trading at 6966. Immediate support lies at 6850, 6700 and resistance at 7120.

DAX -

- DAX is doing well to start off the week. DAX is the strongest performer today among key Europe counterpart.

- Larger trend remains upwards, however bears remain in control in shorter term. Bearish engulfing in weekly chart providing the necessary strength to bears. Target coming around 10550, should resistance at 11750 holds.

- DAX is currently trading at 11555. Immediate support lies at 10550 and resistance at 11750, 12080 around.

EuroStxx50 -

- Stocks across Europe are mixed today.

- Germany is up (+0.95%), France's CAC40 is down (-0.03%), Italy's FTSE MIB is down (-1.54%) and Spain's IBEX is down (-0.15%).

- EuroStxx50 is currently trading at 3572, down -0.28% today. Support lies at 3450, 3300 and resistance at 3760

Nikkei -

- Nikkei has diminished bearish bias and likely to rise further. Bullish hammer like candle in weekly chart providing the necessary support.

- Nikkei is currently trading at 19910. Key support is at 18900, 18400 and resistance at 20080 area.

|

S&P500 |

+0.00% |

|

FTSE |

-0.13% |

|

DAX |

+0.75% |

|

EuroStxx50 |

-0.28% |

|

Nikkei |

+0.64% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand