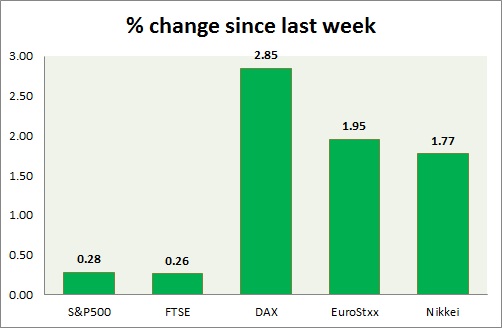

Equities are back in favor this week. Performance this week at a glance in chart & table -

S&P 500 -

- S&P broke into new all-time high as ECB declared to increase purchase rate for May and June.

- Housing data roared into positive in April with building permits growing to 1.143 million from 1.042 million and Housing starts to 1.135 million from 0.926 million in March.

- S&P 500 is currently trading at 2128. Immediate support lies at 1980, 2040 and resistance 2125, 2164.

FTSE -

- FTSE gained amid weaker than expected inflation. Lower inflation means longer accommodative monetary policies.

- FTSE is currently trading at 6993, struggling to clear 7000 mark. Immediate support lies at 6850, 6700 and resistance at 7120.

DAX -

- DAX gained further as ECB official hinted at higher purchase rate in May and June due to seasonal factor.

- Bears gave up due to bullish indication from ECB commentary. Upside target is coming at 12600-12700 with stop at 11100.

- DAX is currently trading at 11796. Immediate support lies at 11250 and resistance at 12080 around.

EuroStxx50 -

- Stocks across Europe are all trading in green, as dovish comments from ECB official provided the necessary support.

- Germany is up (+1.85%), France's CAC40 is up (+1.9%), Italy's FTSE MIB is up (+1.66%) and Spain's IBEX is up (+1.11%).

- EuroStxx50 is currently trading at 3654, up 1.6% today. Support lies at 3450, 3300 and resistance at 3760

Nikkei -

- Nikkei has diminished bearish bias and likely to move towards its bullish target of 20800 area.

- Nikkei is currently trading at 20130. Key support is at 19500, 19000 and resistance at 20300 area.

|

S&P500 |

+0.28% |

|

FTSE |

+0.26% |

|

DAX |

+2.85% |

|

EuroStxx50 |

+1.95% |

|

Nikkei |

+1.77% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings