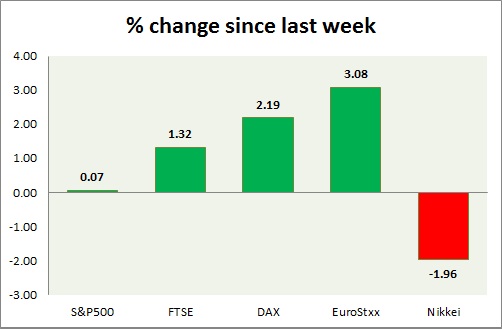

Equities are all trading in green today as risk aversion subsided further. Performance this week at a glance in chart & table -

S&P 500 -

- S&P once again got support around 2040 area, trying to clear resistance around 2080 area.

- S&P500 unless clears above 2100 area, selling pressure likely to persist.

- S&P 500 is currently trading at 2075. Immediate support lies at 1980, 2040 and resistance 2100.

FTSE -

- FTSE is sharply up today as budget improved sentiment and Greek deal seems likely over weekend. Today's range 6690-6550.

- FTSE is currently trading at 6680. Immediate support lies at, 6050 and resistance at 7000. 6750 area is likely to provide resistance.

DAX -

- DAX is sharply up again today as Greek commitments seem to be enough to secure initial approval. Today's range 11380-10960

- DAX is currently trading at 11350. Immediate support lies at, 10500 and resistance at 11500, 12100 around.

EuroStxx50 -

- Stocks across Europe are all trading in green as market is more confident over a weekend deal or commitment on Greece.

- Germany is up (+2.9%), France's CAC40 is up (+3.1%), Italy's FTSE MIB is up (3.1%), Portugal's PSI 20 is up (+3%), Spain's IBEX is up (+3.1%)

- EuroStxx50 is currently trading at 3543, down by +4% today. Support lies at 3300 and resistance at 3760.

Nikkei -

- Nikkei moved higher on global optimism over Greek deal and as yen dropped further.

- Nikkei remains worst performer this week.

- Nikkei is currently trading at 20060. Key support is at 19500 and resistance at 20500 area.

|

S&P500 |

+0.07% |

|

FTSE |

+1.32% |

|

DAX |

+2.19% |

|

EuroStxx50 |

+3.08% |

|

Nikkei |

-1.96% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings