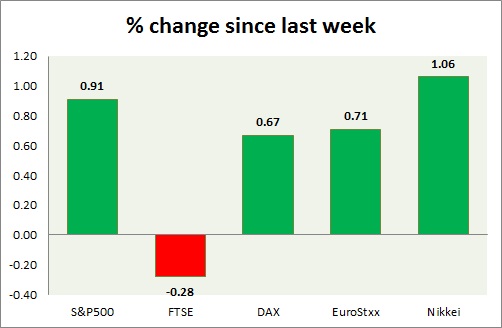

Equities started the week in relatively strong footing. Performance this week at a glance in chart & table -

S&P 500 -

- S&P sharply higher today due to global risk on theme. Today's range 2101-2077.

- US labor market condition index came at 1.1, prior revised to 1.4.

- S&P 500 is currently trading at 2097. Immediate support lies at 1980, 2040 and resistance 2150.

FTSE -

- FTSE is trailing today as miners continue to drag the index. Today's range 6750-6765.

- FTSE is currently trading at 6715. Immediate support lies at, 6050, 6450 and resistance at 6850, 7000.

DAX -

- DAX is up, as investors continue to pour money to European equities. Today's range 11430-11600.

- DAX is currently trading at 11590. Immediate support lies at, 11000 area and resistance at 11800 around.

EuroStxx50 -

- Stocks across Europe are trading green today.

- Germany is up (+0.89%), France's CAC40 is up (+0.59%), Italy's FTSE MIB is up (+1.08%), Portugal's PSI 20 is up (+0.45%), Spain's IBEX is up (+1.20%)

- EuroStxx50 is currently trading at 3670, up by +0.71% today. Support lies at 3300 and resistance at 3760.

Nikkei -

- Nikkei is higher today. However, while weaker Yen is bolstering confidence, weaker than expected economy raising eyebrows.

- Nikkei is currently trading at 20870, with support around 20000 and resistance at 21000.

|

S&P500 |

+0.91% |

|

FTSE |

-0.28% |

|

DAX |

+0.67% |

|

EuroStxx50 |

+0.71% |

|

Nikkei |

+1.06% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand