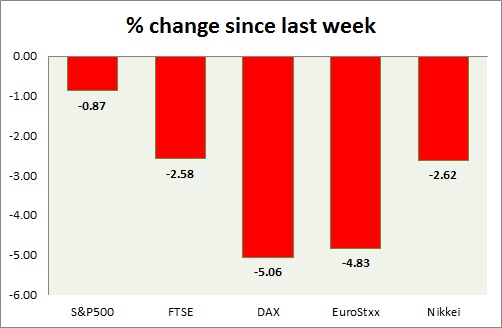

Another devaluation from China soured equities. Performance this week at a glance in chart & table -

S&P 500 -

- S&P sharply down further today due to sell offs over China's action to devalue currencies for second consecutive day. Today's range 2090-2051.

- S&P 500 is currently trading at 2060. Immediate support lies at 1980, 2040 and resistance 2150.

FTSE -

- FTSE is down due to miners' drag and global risk aversion. Today's range 6678-6534.

- FTSE is currently trading at 6580. Immediate support lies at, 6050, 6450 and resistance at 6850, 7000.

DAX -

- DAX is down by -3.4% as investors dump equities over second consecutive devaluation from China. Today's range 11305-10890.

- DAX is currently trading at 11930. Immediate support lies at, 10500 area and resistance at 11800 around.

EuroStxx50 -

- Stocks across Europe are trading red today amid global risk aversion.

- Germany is down (-3.4%), France's CAC40 is down (-3.6%), Italy's FTSE MIB is down (-3%), Portugal's PSI 20 is down (-1.1%), Spain's IBEX is down (-2.3%)

- EuroStxx50 is currently trading at 3486, down by -3.4% today. Support lies at 3300 and resistance at 3760.

Nikkei -

- Stronger Yen provided additional drag on Nikkei today, amid global selloffs over Chinese devaluation of Yuan.

- Nikkei is currently trading at 20110, with support around 20000 and resistance at 21000.

|

S&P500 |

-0.87% |

|

FTSE |

-2.58% |

|

DAX |

-5.06% |

|

EuroStxx50 |

-4.83% |

|

Nikkei |

-2.62% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?