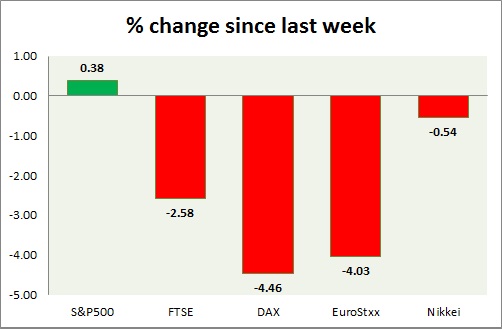

Equities are mixed to end the week. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is showing uncertainty as traders are back and forth in green and red. Today's range 2089-2077.

- Producer price index rose by 0.3% in July, excluding Food and energy.

- Industrial production rose by 0.6% in July.

- Michigan consumer sentiment dropped to 92.9 from 93.1

- S&P 500 is currently trading at 2086. Immediate support lies at 1980, 2040 and resistance 2150.

FTSE -

- FTSE dropped further, wiping out this year's entire gains. Today's range 6600-6540.

- FTSE is currently trading at 6560. Immediate support lies at, 6050, 6450 and resistance at 6850, 7000.

DAX -

- DAX reversed initial gains and dropped further. Today's range 11100-10910.

- DAX is currently trading at 11000. Immediate support lies at, 10500 area and resistance at 11800 around.

EuroStxx50 -

- Stocks across Europe are red today as GDP growth turned out to be weaker than expected at 0.3% for second quarter.

- Germany is down (-0.27%), France's CAC40 is down (-0.45%), Italy's FTSE MIB is down (-0.51%), Portugal's PSI 20 is up (+0.12%), Spain's IBEX is down (-0.42%)

- EuroStxx50 is currently trading at 3495, down by -0.4% today. Support lies at 3300 and resistance at 3760.

Nikkei -

- Nikkei is relatively better performer as weaker yen and foreign inflows continued to provide cover.

- Nikkei is currently trading at 20520, with support around 20000 and resistance at 21000.

|

S&P500 |

+0.38% |

|

FTSE |

-2.58% |

|

DAX |

-4.46% |

|

EuroStxx50 |

-4.03% |

|

Nikkei |

-0.54% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary