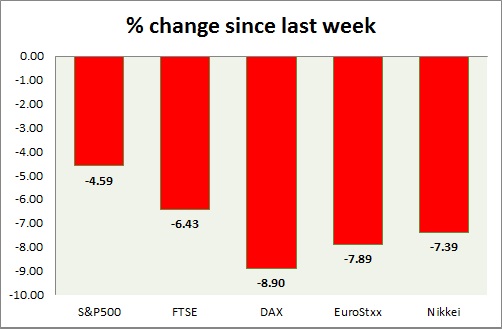

Equities are worst performer this week. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is sharply down again today after bears cleared key support yesterday. Today's range 2032-1990.

- Manufacturing PMI slowed to 52.9 in August from 53.8

- S&P 500 is currently trading at 1997. Immediate support lies at 1980 and resistance 2040.

FTSE -

- FTSE continued its record losing streak, hit by further risk aversion. Today's range 6350-6150.

- FTSE is currently trading at 6160. Immediate support lies at, 6050 and resistance at 6450.

DAX -

- DAX fell to 10000 mark today as selling continued heading into weekend. Today's range 10430-10040.

- DAX is worst performer of the week. Though 10000 is likely to provide some support, price might reach beyond towards 9500 area.

- DAX is currently trading at 10060. Immediate support lies at, 9500 area and resistance at 10500 around.

EuroStxx50 -

- Stocks across Europe are close to wiping out this year's entire gains.

- Germany is down (-3%), France's CAC40 is down (-2.9%), Italy's FTSE MIB is down (-3.2%), Portugal's PSI 20 is down (-2.3%), Spain's IBEX is down (-2.9%)

- EuroStxx50 is currently trading at 3236, down by -2.5% today. Support lies at 3150 and resistance at 3360.

Nikkei -

- Nikkei is no different, global selloffs in equities pushed Nikkei to lowest since March.

- Nikkei is currently trading at 19060, with support around 18500 and resistance at 20500.

|

S&P500 |

-4.59% |

|

FTSE |

-6.43% |

|

DAX |

-8.90% |

|

EuroStxx50 |

-7.89% |

|

Nikkei |

-7.39% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate