The shift in China's FX regime in August and coincident slowing of the Chinese economy has significant direct and implied ramifications for the global economy, including the euro area and the EUR.

The slowing of China's economy, with downside risks, should reduce global aggregate demand, exposing the euro area both directly and through its other emerging market trading partners.

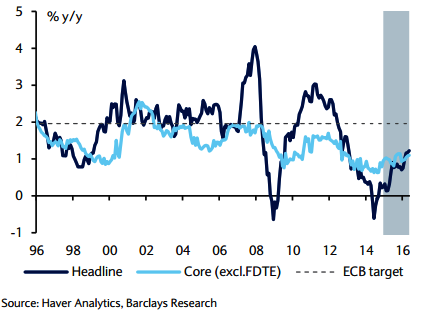

Moreover, the significant depreciation of CNY, that is expected, likely will increase disinflationary pressures globally, increasing the already considerable downside risks to euro area inflation stemming from tightening of financial conditions, falling oil prices and a still large output gap.

"Indeed, the euro area inflation is expected to be materially below the ECB's target next year and, as such, expect the ECB to ease policy further by year-end", says Barclays.

Euro area inflation likely to be below ECB’s target next year

Wednesday, September 23, 2015 5:19 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022