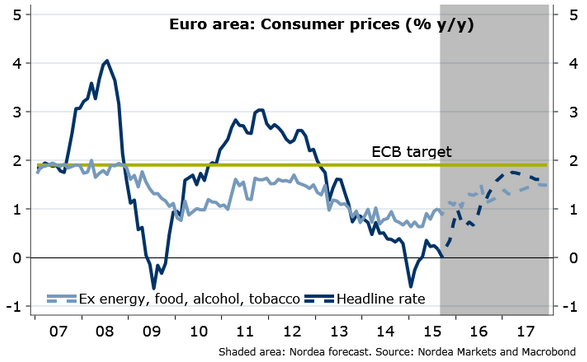

Since February 2013, the Euro-area inflation rate has been below 2% y/y. The less volatile core rate (ex food, energy, alcohol and tobacco) even since March 2008. Production capacities in the Euro area are still under-utilised to a large degree. Estimates of the output gap are notoriously uncertain; it could currently amount to some 2% of potential output - no environment to negotiate big wage increases. Against this background, the wage growth and core inflation are expected to pick up very gently over the forecast horizon.

"The current headline inflation rate is just 0.2% y/y. In the short run, the decline in oil prices could easily push it back below zero. Assuming broadly unchanged oil prices over the next months, the inflation rate is likely to rise to roughly 1% y/y by January 2016 as last year's steep fall in energy prices will drop out of the rate and likely to increase by 1.6% in 2017. Later in Q1 next year, base effects will likely drive down the inflation rate again, as oil prices rose markedly in early 2015. This will leave ample room for the ECB to continue with its zero interest rate policy and possibly more aggressive or longer lasting asset purchases", said Nordea Bank in a research note ot its Client.

Euro-area inflation to rise moderately in 2016

Wednesday, September 9, 2015 6:37 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX