Recent hard economic data suggest that, similar to last year, euro area output data could disappoint over the summer months. Industrial production fell in May and June, meaning market expectations of solid GDP growth in Q2 and Q3 could be disappointed.

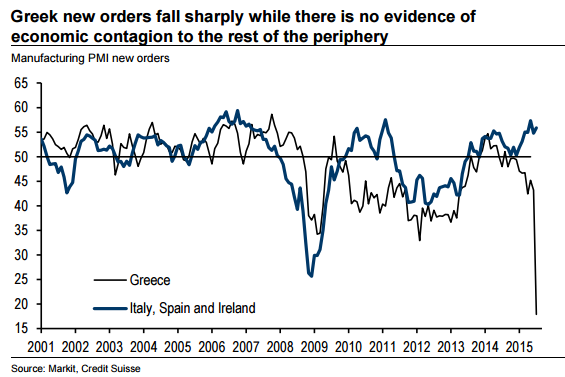

Much like last year, there are good reasons to expect any "soft patch" in hard economic data to be transient. But given the turbulence in Greece in recent months, the weakness may lead market participants to be concerned that the associated volatility and uncertainty have had an impact beyond Greece.

This weakness is more "statistical" than "fundamental". Survey indicators - which generally have a higher signal to noise ratio than hard data - have been resilient in recent months. And although economic and financial circumstances in Greece are grim, there is no evidence of economic or financial contagion to the rest of the euro area.

"Although markets may be about to absorb a run of downside surprises in euro area cyclical data, we remain confident that the euro area economy will steadily continue its ongoing recovery," says Credit Suisse.

Euro area output data could disappoint over the summer months

Tuesday, August 11, 2015 12:57 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed