Since European Central Bank (ECB) disappointed in December, sentiment started deteriorating in Euro zone. New Year turmoil across global stock market increased the tempo of deterioration.

- European Central Bank (ECB) again gave assurance to act in March further and keep policy very accommodative for very long and that might boost sentiment from March.

- Concern over immediate hard landing in China and weakness in emerging markets likely to weigh on sentiment, however comments from this weekend's G20 finance ministers' meeting might improve business sentiment.

- Business prospect is however great with weaker Euro improving competitiveness of Euro area however domestic economies are facing some loss of momentum.

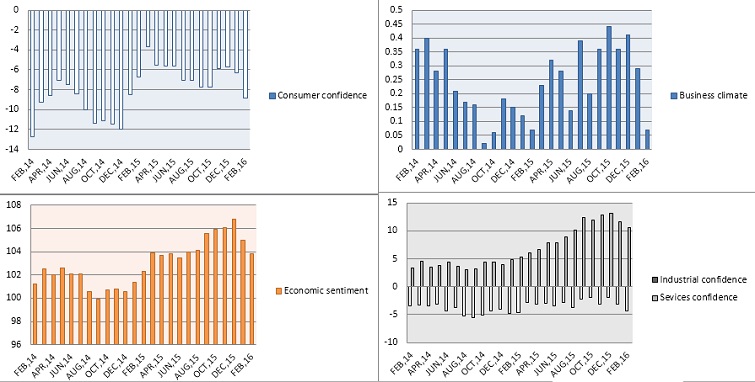

Today's economic survey showed that sentiment across Euro zone dropped sharply.

- Euro zone business climate dropped to 0.07 in February, lowest reading since February, 2015.

- Industrial confidence dropped to -4.4 lowest since February, 2015. Economic sentiment soured to 103.8, worst reading since May, 2015.

- Services sentiment dropped drastically to 10.6, lowest reading since August, 2015.

- Consumer confidence dropped to -8.8, worst reading since December, 2014.

Euro is currently trading at 1.102 against Dollar.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal