At the peak of the crisis, unemployment in U.S. was hovering around 10%, which is clearly not being considered as healthy and Federal Reserve has taken unprecedented steps in monetary policy easing to tackle the unemployment, since dual mandate of FED includes maximum employment possible under price stability. Unemployment rate in Euro zone currently stands at 11.1%.

However on the other hand European Central Bank (ECB) has also taken up unconventional policy easing but at the sake of fragmentation.

However, without any central co-ordination from the fiscal side ECB alone is unlikely to succeed even if it wants to lower unemployment.

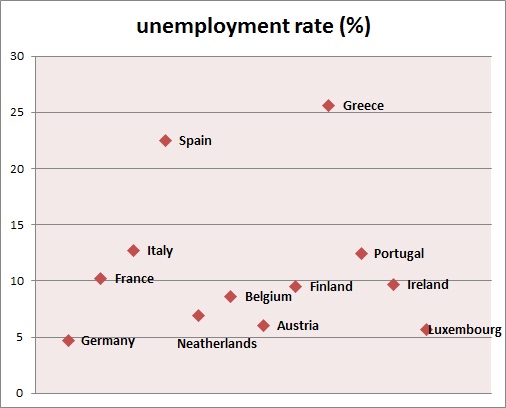

As of now, it is quite clear from the unemployment rate that Euro zone is far away from economic activities which can be labelled as normal.

European Central Bank (ECB) and fiscal authorities need not only to focus on monetary policy fragmentation but employment fragmentation.

- As of latest report, unemployment rates are extremely fragmented. While unemployment rate is at 4.7% in Germany, 5.5% in Malta, 5.7% in Luxembourg, 6% in Austria, rates are way higher in France (10.2%), Italy (12.7%) and Spain (22.5%). We are not even talking Greece and youth unemployment.

Unless this issue is tackled, Euro zone will keep facing challenges from Euro-skeptics, who are clearly on the rise across Europe.

Federal Judge Orders Refund of Trump’s Emergency Tariffs, Potentially Returning Up to $182 Billion

Federal Judge Orders Refund of Trump’s Emergency Tariffs, Potentially Returning Up to $182 Billion  Asian Stocks Rebound as KOSPI Surges, China Signals Stimulus Amid Global Tensions

Asian Stocks Rebound as KOSPI Surges, China Signals Stimulus Amid Global Tensions  Australia and Canada Strengthen Critical Minerals Partnership Through New G7 Alliance Agreements

Australia and Canada Strengthen Critical Minerals Partnership Through New G7 Alliance Agreements  EU Seeks Stronger Canada Trade Ties Amid Uncertainty Over U.S. Tariff Policy

EU Seeks Stronger Canada Trade Ties Amid Uncertainty Over U.S. Tariff Policy  ADB: Short Strait of Hormuz Closure Would Have Limited Impact on Developing Asia Growth

ADB: Short Strait of Hormuz Closure Would Have Limited Impact on Developing Asia Growth  Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight

Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight  Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume

Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume  BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply

Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply  Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion

Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion