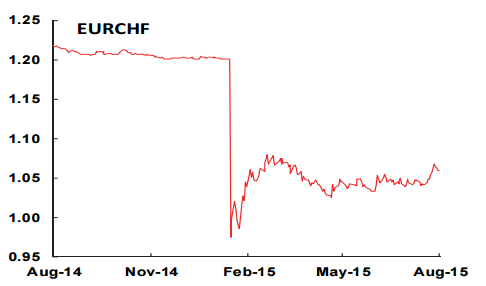

The path of the British pound (GBP) is one of relative performance, softening vs. the USD while climbing against its peers in light of the Bank of England whose normalization is expected to lag the Fed's in both timing and scope. Risk for the EUR remains biased to further weakness as we look to greater divergence between the Fed and the European Central Bank, with the passing of Greece-driven uncertainty providing for a renewed focus on fundamentals. This dynamic has been most clearly evident in the value of the Swiss franc (CHF), its accelerated depreciation observed in response to the moderation in investor risk aversion.

"We expect CHF to weaken vs. both USD and EUR throughout our forecast profile. The Swedish krona (SEK) and the Norwegian krone (NOK) are most vulnerable into year-end, and we look to their stabilization over the course of 2016," notes scotiabank.

Europe: Foreign exchange outlook

Thursday, July 30, 2015 9:06 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX