Europe will regain its share in world trade, while China looses

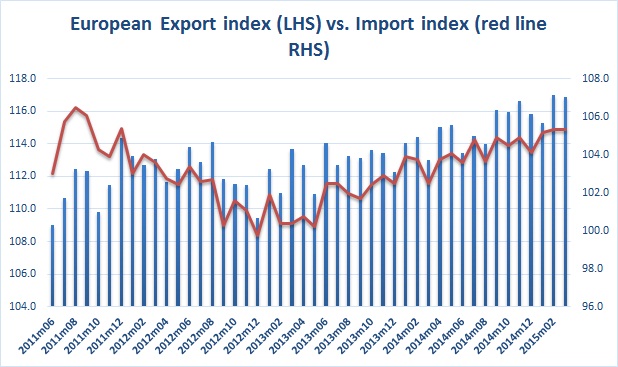

Latest data from CPB World Trade Monitor shows that recovery is gathering pace in Europe In 2015 in terms of total trade. Both imports and exports are going up, with exports recovering at rapid pace.

- European import index reached highest level (105.3) not seen since 2011, before debt crisis and European export index reached to level in 2015 (117), not seen since 2008, before financial crisis.

European Central bank has successfully brought Euro zone back into growth path with its policies such Outright monetary transactions (OMT), Long term refinancing operation (LTRO), Targeted LTRO ( T-LTRO) , Securities market purchase program (SMPP).

With weaker Euro, Euro zone economies are all set to claw back their share in World trade. In 2003-04 European Union had 23% share of world which as per latest data fell close to 15% by 2013.

China stands to lose more with weaker exchange rate in Europe making Chinese goods less competitive to local ones. Moreover Chinese companies are most likely to face tougher trade laws and sanctions from US and over its subsidies and exchange rates.

European stocks will gain in terms of revenue over the coming years, if not decade which makes European stocks good long term bet.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary