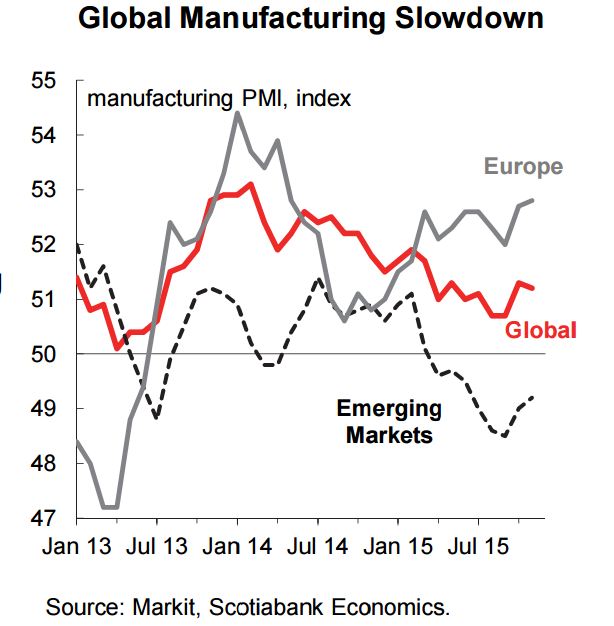

Global manufacturing has been softening since early 2014. The descent is driven by a slowdown in emerging markets as China transitions away from a manufacturing to a services-based economy, and Brazil and Russia struggle with deep recessions and political turmoil.

Chinese manufacturing contracted for the 9th consecutive month in November, as factories are being squeezed by slowing domestic and international demand, as well as increasing competition from emerging Asia. The Chinese government is pushing the manufacturing industry to transform and move up the value chain to compete with South Korea and Japan, as opposed to lower-cost centers such as Vietnam and Indonesia. Increases in labor and land costs over the last few years have reduced China's competitiveness with its emerging Asian counterparts, and ongoing structural reforms will lead to a difficult environment for the manufacturing sector in the coming years.

In contrast, manufacturing activity in Europe has improved since the start of this year, and every country tracked in the region (with the exception of Greece) posted a moderate to strong expansion in November. European out-performance should extend into 2016, building on its current momentum. The slow and steady expansion in the manufacturing PMI enters its 29th consecutive month in November, with particular strength in Italy, Spain and Germany. Of concern is the lack of inflationary pressures that would allow manufacturers to raise prices, which have fallen for three consecutive months and are crimping profits. Somewhat offsetting the effect of falling prices for finished goods are lower input costs such as steel and fuel.

European PMI outperformance can't offset Chinese manufacturing slowdown

Saturday, December 19, 2015 8:48 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX