Measures have been launched since Euro zone debt crisis of 2011/12, to tackle weak economy, higher unemployment and lower inflation.

- European lawmakers since the crisis has introduced, banking union, budgetary controls, bailout programs while European Central Bank (ECB) has launched OMT to tackle risk arriving from contagion and debt crisis, started full scale asset purchase program in 2015.

Yet all has failed to tackle one issue, which is higher unemployment in Euro area. As of latest, Euro area unemployment rate stands close 11.3%.

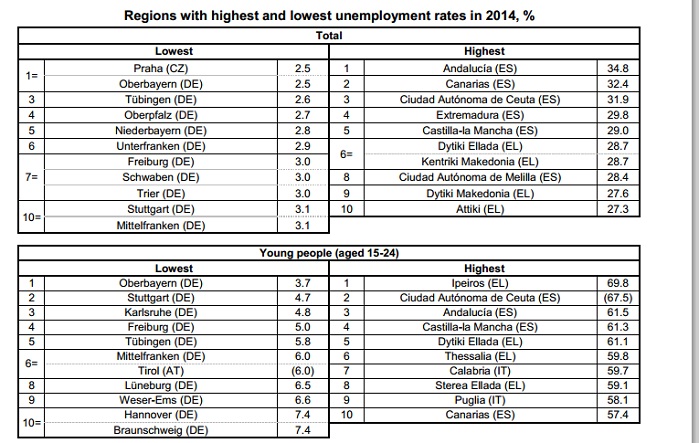

Going through finer details published by Euro stat, one can find astonishingly high unemployment numbers which indicate that boom time for Europe is still far-fetched dream.

- Overall unemployment rate in Spain is still at 23.1% and Greece is at 26%.

- Regional unemployment remains highest in Andalucía at 34.8%, followed by Canarias (32.4%), Ceuta (31.9%), Extremadura (29.8%), and Mancha (29%), all in Spain.

- Highest youth unemployment is observed in Iperios region of Greece at 69.8%.

It would be very premature to think about boom time in Europe with this staggeringly high numbers, rather it would only be fair to say, Europe is recovering and recovery is gathering pace. There is no point calling for an early exit by European Central Bank from its QE program until recovery in employment reaches sustainable level.

In Chart, ES stands for Spain, EL for Greece, DE for Germany, IT for Italy, AT for Austria and CZ for Czech Republic.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?