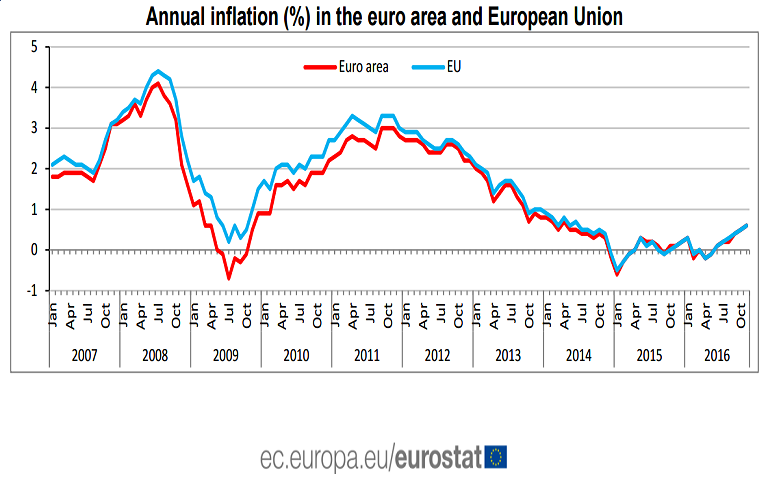

According to data released by Eurostat, the statistical office of the European Union, on Friday, inflation in the eurozone crept up again in November, inline with expectations. According to the Eurostat’s final reading, of eurozone annual CPI reading came in at 0.6 percent in November, matching consensus forecast and higher than 0.5 percent preliminary figure.

However, the more important core rate showed no growth and stayed unchanged from 0.8 percent seen in October, matching forecasts for a 0.8 percent increase. The core rate declined slightly from the 0.9 percent rate seen in November 2015. Data suggests that core inflation has not yet responded to the ECB's ultra-loose monetary policy.

The largest boost to euro area annual inflation came from restaurants & cafés which added +0.07 percentage points, rents and tobacco both contributed +0.04 pp, while gas and heating oil detracted -0.11 and -0.05 pp respectively.

In November, negative annual rates were observed in six Member States. The lowest annual rates were registered in Bulgaria and Cyprus (both -0.8 percent). The highest annual rates were recorded in Belgium (1.7 percent), the Czech Republic (1.6 percent) and Austria (1.5 percent)," Eurostat said.

Energy prices fell 0.2 percent on the month and 1.1 percent y/y and compared with a 7.3 percent decline in the year to November. Prices for non-energy industrial goods were unchanged on the month with an annual rate of 0.3 percent. Services sector prices fell 0.3 percent on the month and held at 1.1 percent y/y compared with 1.2 percent in November 2015.

Industrial sector saw strong increase in inflationary pressures, but the European Central Bank (ECB) will probably want to see evidence of a firmer trend in this sector before being more confident in an overall increase in inflation. Faster pace of rise in services sector prices may add pressure on the ECB for a less aggressive monetary policy.

EURUSD jumps to a session high of 1.0472 following the release of eurozone CPI print. Technically, upside in the pair is capped by 3- day EMA. Strong support is seen at 1.03400 (127.2% retracement of 1.03665 and 1.04720) and any violation below will drag the pair till 1.02835 (161.8% retracement of 1.05047 and 1.08700). Break above 3-day EMA will take the pair to next level till 1.05250/1.0551 (5- day MA). Short term bullishness only above 1.06700 level.

FxWirePro's Hourly EUR Spot Index was at 31.0521 (Neutral), while Hourly USD Spot Index was at 134.359 (Highly bullish) at 0850 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal