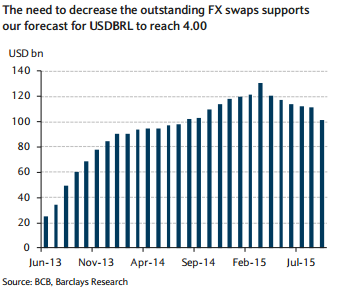

The central bank of Brazil holds a meaningful amount of FX swaps; unwinding them would exert further pressure on a weak BRL. The BCB has about USD102bn of swap contracts outstanding, and reducing them is particularly challenging in the context of widespread pressures on the currency.

Currently, the central bank is rolling over all the contracts that are due to expire in the next few months, implying that the outstanding stock will soon have maturities beyond 2016. On the one hand, reducing this stock would decrease the fiscal costs that these operations incur when the exchange rate weakens, but on the other hand, it puts upside risks to inflation next year, says Barclays.

Alternatively, the BCB could sell part of its international reserves to reduce the swaps outstanding. This implies decreasing the fiscal costs without pressuring inflation, but also decreasing the external fundamental soundness at a critical moment. This leaves a comfortable with the view that the currency has room to weaken even at current levels, especially if fiscal execution continues to challenge the government, added Barclays.

Experts suggest BCB to unwind its swaps contracts

Thursday, September 10, 2015 4:59 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX